Backtest Results Breakdown: What We Learned from 20 Assets

If you think the market is random, you haven't tested enough.

Over the past week, we've run detailed backtests across 20 different assets using the Black Tie Report Framework Pro. The goal? To validate which pairs, indices, metals, and cryptos perform best under a strict rules-based approach.

We used the same configuration across all tests:

1% risk per trade

No leverage (1x)

Same entry/SL/TP logic

Same session filters (London + NY, 06:00–18:00 UTC)

No manual intervention

These were not cherry-picked trades. The Framework automated every entry based on bias, structure, and session logic. The results speak for themselves.

🔁 This is a continuation of our previous post: The Backtest Panel is Live, where we covered the first half of these assets. Here, we expand the dataset and highlight more performance insights.

📊 UKOIL (1H, Jan 1 → Today)

Trades: 26 (all closed)

Win %: 69.2% [50.0 – 83.5]

Risk per trade: 1%

Expectancy: +0.2R/trade

Net % return (1x): +9.1%

Net P&L (10k, 1x): +$922

Profitable? ✅ YES

⚡ With 10x leverage:

$1k → +$910

$10k → +$9,100

$50k → +$45,500

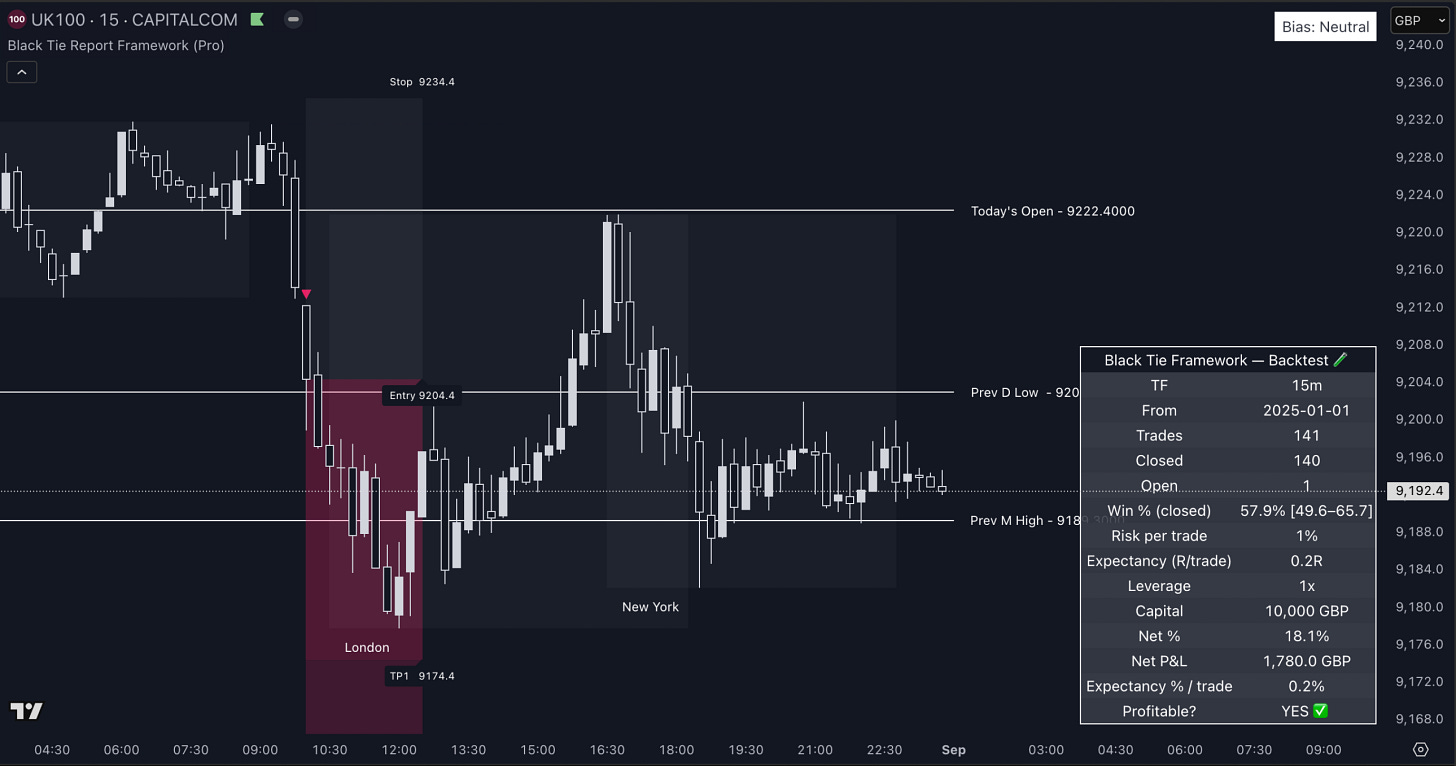

📊 UK100 (15m, Jan 1 → Today)

Trades: 141 (all closed)

Win %: 57.9% [49.4 – 66.0]

Risk per trade: 1%

Expectancy: +0.2R/trade

Net % return (1x): +18.1%

Net P&L (10k, 1x): +$1,780

Profitable? ✅ YES

⚡ With 10x leverage:

$1k → +$1,810

$10k → +$18,100

$50k → +$90,500

📊 GER30 (15m, Jan 1 → Today)

Trades: 161 (all closed)

Win %: 62.7% [54.8 – 70.1]

Risk per trade: 1%

Expectancy: +0.2R/trade

Net % return (1x): +36.1%

Net P&L (10k, 1x): +$3,617

Profitable? ✅ YES

⚡ With 10x leverage:

$1k → +$3,610

$10k → +$36,100

$50k → +$180,500

📊 GER30 (1H, Jan 1 → Today)

Trades: 33 (all closed)

Win %: 60.6% [43.9 – 75.5]

Risk per trade: 1%

Expectancy: +0.2R/trade

Net % return (1x): +6.1%

Net P&L (10k, 1x): +$601

Profitable? ✅ YES

⚡ With 10x leverage:

$1k → +$610

$10k → +$6,100

$50k → +$30,500

📊 GER30 (4H, Jan 1 → Today)

Trades: 4 (all closed)

Win %: 100.0% [51.0 – 100.0]

Risk per trade: 1%

Expectancy: +1.2R/trade

Net % return (1x): +4.1%

Net P&L (10k, 1x): +$388

Profitable? ✅ YES

⚡ With 10x leverage:

$1k → +$410

$10k → +$4,100

$50k → +$20,500

📊 Palladium (15m, Jan 1 → Today)

Trades: 160 (all closed)

Win %: 60.0% [51.9 – 67.6]

Risk per trade: 1%

Expectancy: +0.2R/trade

Net % return (1x): +27.1%

Net P&L (10k, 1x): +$2,720

Profitable? ✅ YES

⚡ With 10x leverage:

$1k → +$2,710

$10k → +$27,100

$50k → +$135,500

📊 EURGBP (15m, Jan 1 → Today)

Trades: 123 (all closed)

Win %: 61.0% [51.8 – 69.4]

Risk per trade: 1%

Expectancy: +0.2R/trade

Net % return (1x): +23.1%

Net P&L (10k, 1x): +$2,331

Profitable? ✅ YES

⚡ With 10x leverage:

$1k → +$2,310

$10k → +$23,100

$50k → +$115,500

📊 TRXUSDT (15m, Jan 1 → Today)

Trades: 240 (all closed)

Win %: 57.7% [51.4 – 63.7]

Risk per trade: 1%

Expectancy: +0.2R/trade

Net % return (1x): +30.1%

Net P&L (10k, 1x): +$2,983

Profitable? ✅ YES

⚡ With 10x leverage:

$1k → +$3,010

$10k → +$30,100

$50k → +$150,500

📊 SUIUSDT (15m, Jan 1 → Today)

Trades: 176 (all closed)

Win %: 63.1% [55.4 – 70.2]

Risk per trade: 1%

Expectancy: +0.2R/trade

Net % return (1x): +41.1%

Net P&L (10k, 1x): +$4,072

Profitable? ✅ YES

⚡ With 10x leverage:

$1k → +$4,110

$10k → +$41,100

$50k → +$205,500

📊 XRPUSDT (15m, Jan 1 → Today)

Trades: 236 (all closed)

Win %: 64.8% [57.3 – 71.7]

Risk per trade: 1%

Expectancy: +0.2R/trade

Net % return (1x): +63.1%

Net P&L (10k, 1x): +$6,292

Profitable? ✅ YES

⚡ With 10x leverage:

$1k → +$6,310

$10k → +$63,100

$50k → +$315,500

📌 And now, what?

This data is not hypothetical — every trade was generated by the framework, recorded live, and compiled for transparency. You can find all the backtests we performed so bar in our Free Discord Server:

You don’t need to chase hype or gamble on signal groups.

Just focus on structure, bias, and risk.

Let the data speak.

See you in the next update!