The Industry of Illusions

Open Twitter (or “X”) on any given day and you’ll find the same parade: charts with hindsight arrows, “mentors” claiming 90%+ win rates, endless ICT jargon recycled without understanding.

If you’re new, the noise is overwhelming. If you’ve been around for a while, you know most of it is misleading at best, destructive at worst.

The truth?

Most people lose money in trading. Not because the market is impossible, but because they enter it with the wrong mindset, the wrong expectations, and a complete misunderstanding of what real professional trading looks like.

This article is not about motivation. It’s about reality. And the reality is simple: you don’t need secret patterns, you don’t need to understand every new ICT acronym, and you definitely don’t need to chase “signals.”

You need structure, discipline, and an understanding of what actually works.

The Win-Rate Myth

One of the most dangerous lies pushed on social media is the obsession with win rate.

You’ve seen the claims: “I never lose.” “My strategy is 95% accurate.”

In reality, the best traders in history rarely had win rates higher than 50–60%.

Paul Tudor Jones, one of the most successful traders alive, is public about his approach: small risk per trade, cut losers fast, let winners run. His career wasn’t built on winning every trade — it was built on protecting capital and striking when conditions aligned.

Bruce Kovner, profiled in Market Wizards, spoke openly about the importance of risk management over prediction. His focus wasn’t on being “right” all the time, but on surviving long enough to compound.

Bill Lipschutz, the “Sultan of Currencies,” famously said: “If most traders would learn to sit on their hands 50 percent of the time, they would make a lot more money.” His win rate was far from perfect — but his control over size and patience made him legendary.

What separates professionals from the average trader isn’t accuracy. It’s discipline.

If you’re chasing “100% win rate,” you’re not trading. You’re gambling.

The Real Enemies: Impulse and Overtrading

Ask yourself: why do most retail traders fail?

It’s not the market. It’s not the lack of knowledge. It’s impulse.

Entering trades without confluence.

Overleveraging after a small win.

Refusing to stop after 3 consecutive losses.

Jumping between strategies every month.

Believing social media promises instead of building a structured plan.

The math is against you if you do this. Even with a decent edge, poor risk management will drain your account faster than any “bad market condition.”

That’s why professional traders obsess over capital preservation. The first rule is never making money. It’s not losing money.

Why ICT Jargon Doesn’t Make You Profitable

The last 2 years have been dominated by one trend: ICT. “Smart money concepts.”

Order blocks, fair value gaps, liquidity sweeps.

Here’s the problem: most people using this jargon don’t actually understand it. They memorize definitions and redraw boxes, hoping it will suddenly make them consistent.

But consistency doesn’t come from labels. It comes from structure.

You don’t need 20 new terms every week.

You don’t need to map out “liquidity sweeps” at three decimal places.

You don’t need to mimic ICT’s personality to trade well.

What you need is a framework that filters the noise and shows you the conditions that matter. ICT jargon won’t save you from overtrading or ignoring risk.

What Professionals Actually Do

Professional traders — the ones who survive decades, not months — all follow the same underlying principles:

Risk 1% or less per trade.

It keeps you alive through drawdowns.Stop after 3 consecutive losses.

This prevents emotional spirals that kill accounts.Cut losers fast, let winners run.

A 40% win rate with 2:1 R/R is infinitely better than an 80% win rate with no risk control.Trade during liquid sessions.

Volume matters. London and NY are where institutional flows move the market. Weekends? Stay out.Stick to your edge.

A good strategy isn’t about perfection. It’s about applying the same logic over and over, knowing the math will play out.

This is boring. But boring is profitable.

The Signal Trap

Most people on social media aren’t traders. They’re spectators looking for shortcuts.

That’s why “signal groups” thrive. They sell the illusion of safety: “don’t think, just copy.”

But here’s the reality:

If someone is selling you guaranteed signals, they’re lying.

If you need someone else to tell you when to enter, you’re not trading. You’re outsourcing responsibility.

And outsourcing responsibility is the fastest way to stay stuck forever.

True trading is about decision-making within structure. You can have tools, frameworks, and automation — but the final choice must be yours. That’s how you build skill, not dependency.

Why We Built the Framework

At Black Tie Report, we spent years watching traders fail not because they lacked strategy, but because they lacked structure.

That’s why we built the Black Tie Report Framework Pro. Not as a magic bullet. Not as a signal service. But as a tool that removes the noise, automates the analysis, and leaves you with the only job that matters: discipline.

No messy charts.

No overcomplicated setups.

No second-guessing indicators.

Just suggested trades, with entry, stop loss, take profit, and higher timeframe confluence.

Your job is simple:

Stick to 1% risk.

Stop after 3 losses.

Take partials responsibly.

That’s it. The Framework does the heavy lifting. You do the part no one can automate: self-control.

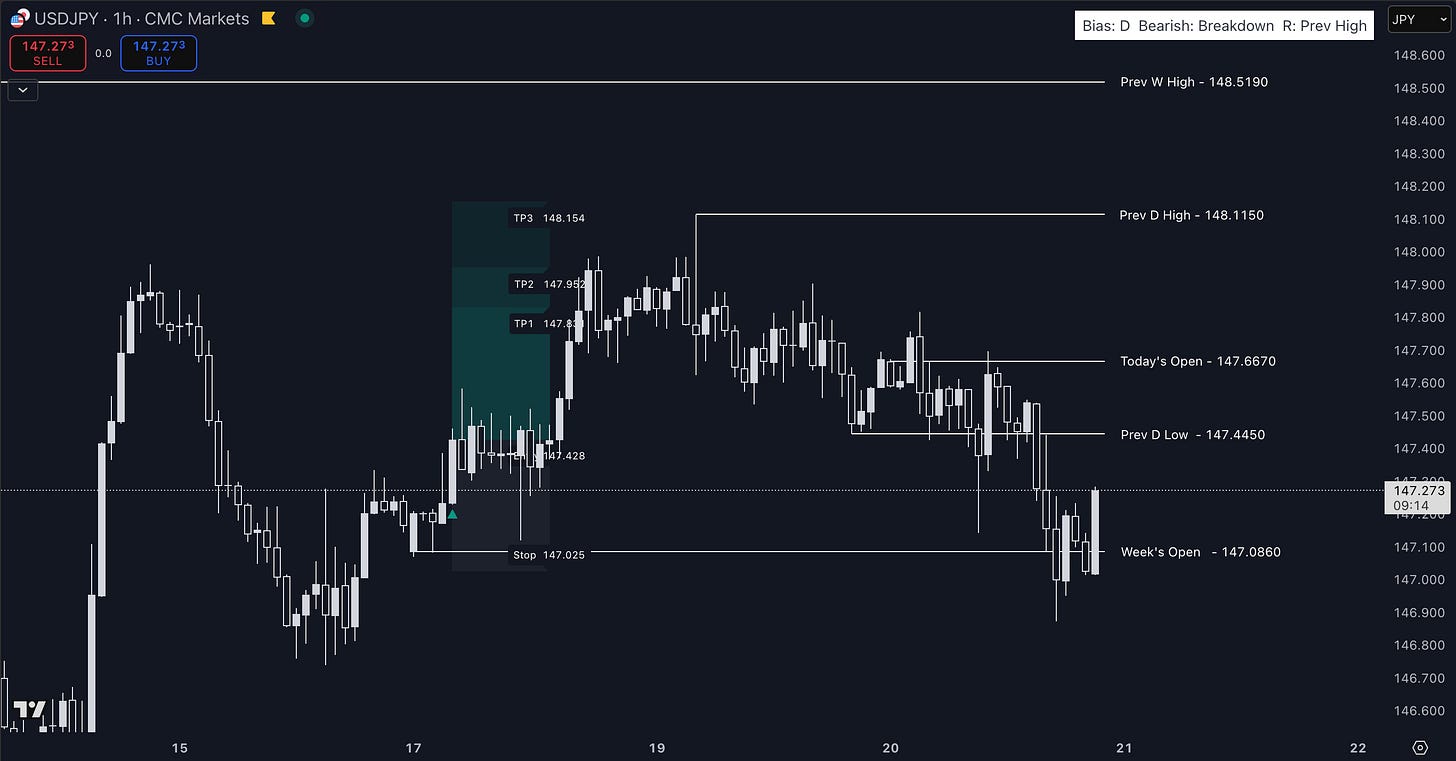

👉 Example 1 - USDJPY - 1H Chart

👉 Example 2 - ETHUSDT - 1H Chart

Freedom Over Screens

Here’s the final truth:

Trading isn’t about making money. It’s about making freedom.

If your trading keeps you glued to a screen, chasing every tick, you’ve already lost.

The goal is to free your time. To let automation handle the repetitive work, so you can focus on living.

We don’t build tools to make people stare at charts longer. We build tools so you can step away — and still trade like a professional.

So, Where Do You Go From Here?

Forget the “gurus” promising perfection. Forget the jargon that makes you feel smart but doesn’t make you profitable. Forget the obsession with win rate.

What matters is structure, discipline, and freedom.

The best traders in history didn’t win all the time.

They didn’t care about signals.

They didn’t spend their lives stuck on Twitter threads.

They built edges, managed risk, and lived to trade another day.

That’s what we believe in. And that’s what we’ll keep building for you.