What No One Tells You About Price Action

Why Most Traders Fail with Price Action — and How to Use It Properly.

Most traders begin their journey with a simple YouTube video.

Someone draws a support line. A bullish candle appears. The price reacts. It bounces perfectly.

The presenter says, "See? It’s that simple."

Then another video shows a textbook breakout — a strong bullish engulfing candle pierces a level, and the market rallies. 1:3 reward-to-risk. No stress.

It feels intuitive. So you open your chart, draw a few lines, and start waiting for the market to cooperate.

You wait. You take the setup. You lose.

Why Price Action Feels Like the Answer

In the beginning, price action appears to make the most sense.

There are no confusing indicators, no complex models. Just clean candles, support and resistance zones, and what looks like logic unfolding in real time.

And to be clear — price action is important. It’s useful. It’s a language you need to learn.

But here’s the part most people skip over:

Price action, on its own, is not enough to become consistently profitable.

Breakouts will fail. Pin bars will mislead you. Support and resistance will stop reacting as expected.

This isn’t because price action is wrong. It’s because most people try to use it in isolation — without any supporting context.

Let’s go deeper.

Why Price Action Alone Fails Most Traders

Imagine trying to trade based solely on how a single candle looks.

You see a strong bullish candle and interpret that as a signal to go long. But what if that candle:

Appeared during low-volume hours?

Formed in the middle of a broad range?

Violated your current bias?

Reacted to a fake breakout or liquidity trap?

In those cases, the candle has little predictive power. You’re not making a decision based on why the candle formed — you’re reacting to what it looks like.

This is the key problem. Price action is not a signal. It is a form of market expression.

If you want to use that expression intelligently, you must combine it with a structured understanding of:

Market bias (Are we trending or ranging?)

Market structure (Are we breaking highs or failing to make new lows?)

Session context (Are we trading during active hours?)

Key levels (Are we reacting to something important?)

Understanding the Role of the Candle

It’s important to clarify this fundamental idea:

The candle confirms the setup — it does not define it.

Many new traders reverse this logic. They treat every pin bar, engulfing candle, or inside bar as a trade signal in itself. But in professional trading, the candle is simply the last confirmation — not the reason you enter.

A truly structured setup requires that you first:

Define the overall bias — ideally on the daily or 4H chart.

Wait for structural confirmation — CHoCH or BOS (Change of Character / Break of Structure).

Identify if the market is currently active — typically London or New York session.

Observe if price is reacting to a meaningful level — such as a previous high, session open, or fair value gap.

Then, and only then, look for a candle that aligns with all of the above.

The candle is simply the final layer of confluence. Nothing more.

So Why Do People Keep Using It Incorrectly?

Because it’s easy to recognize. You can visually spot a hammer or a breakout. You can memorize a few shapes. But understanding why the candle is forming — and whether it matters — is far more difficult.

That’s why most new traders continue to rely on it as a standalone tool. It feels concrete. It looks like a signal. And on enough occasions, it even works — just enough to keep you trying.

But that inconsistency is what burns accounts.

The Role of the Framework

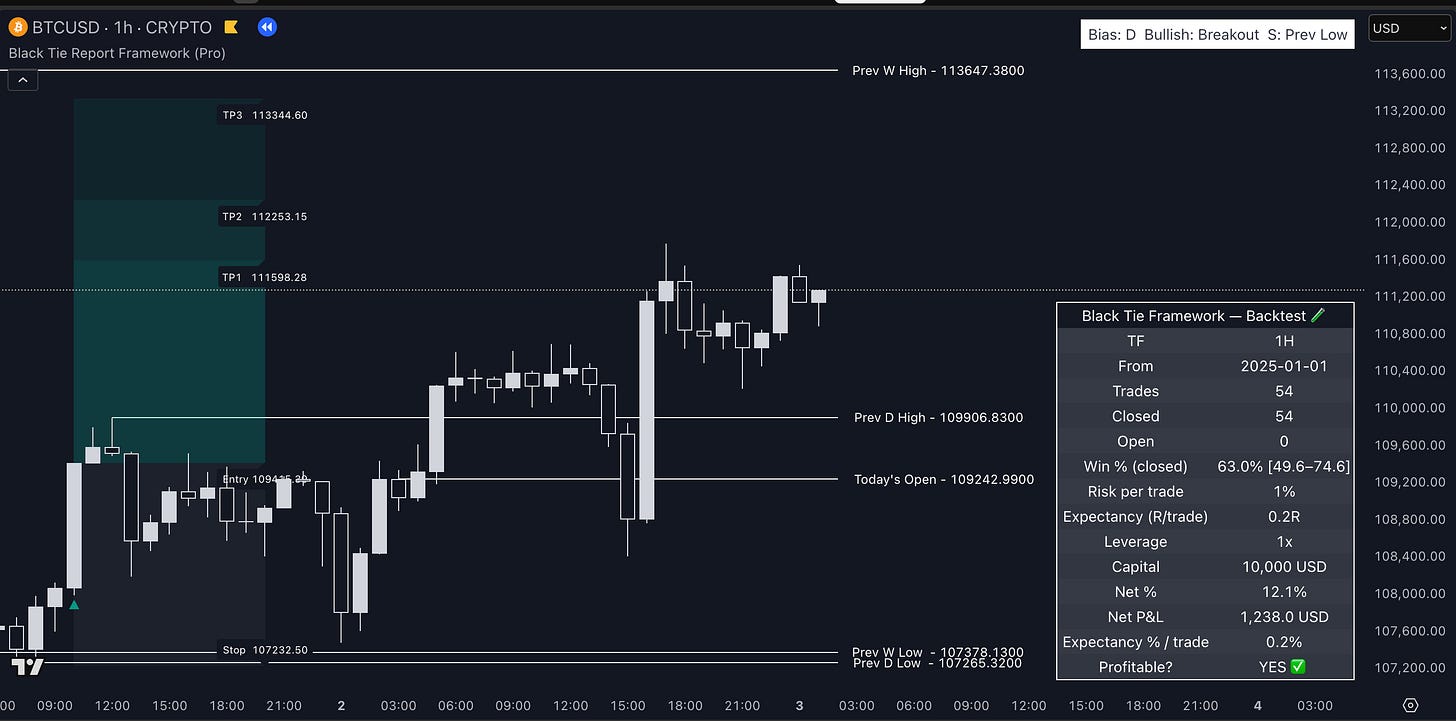

This is precisely why we built the Black Tie Report Framework Pro.

It’s not meant to give you trade signals. It’s not a magic indicator.

It’s a structured system that helps you:

Define bias automatically using daily analysis.

Mark out structural shifts (CHoCH and BOS) on any timeframe.

Draw key levels (weekly opens, session ranges, FVGs).

Highlight impulse moves so you trade strength, not noise.

Backtest all of this in seconds with the built-in Backtest Panel.

When you combine price action with these tools, you stop guessing and start filtering with intention.

Why Most Beginners Get It Wrong

New traders are not wrong because they lack intelligence or effort.

They are wrong because they start in the middle.

They begin with price action — candles, patterns, breakouts — because that’s what social media teaches. But they never learn how to build a context around those patterns.

This is like trying to speak a new language by memorizing words without understanding grammar.

Context is what makes price action reliable.

You need to understand:

What session you’re in

What structure the market is building

Where the liquidity is sitting

Whether your bias aligns with the move

Once you can read that, then price action becomes a valuable tool. But until then, it will only lead to frustration.

Should You Abandon Price Action?

Absolutely not. Price action is foundational. But it must be used in its proper place.

You should:

Use candles as confirmation, not as signals.

Wait for context to develop before acting.

Avoid trading in dead zones (low volume sessions, no bias).

Combine structure, levels, and session analysis with each entry.

When you do that, price action becomes a refined filter instead of a coin toss.

Summary and Next Steps

If you want to succeed in the markets, you need to move beyond reactive trading.

The market is not random. But it is layered. And unless you approach it with a structured lens, you’ll keep falling for setups that look good — but aren’t.

The Framework helps you bring that structure to life:

It defines the bias.

It tracks structure.

It marks levels.

It shows you how the market is behaving across sessions.

And it lets you backtest all of it instantly.

You don’t have to guess. You don’t have to stare at candles for hours.

You just need a system that gives you the information that matters.

You’ll still need discipline. You’ll still need patience.

But you’ll finally understand what price action is trying to tell you — and when to listen.

I hope it helps.