Markets move fast, but structure never lies.

Today’s price action across SPX, EURUSD, USDJPY, BTC, BNB, and SOL gave us a textbook example of how the Black Tie Report Framework Pro filters out noise and prints only the highest-quality setups.

The best part?

You don’t configure anything.

You just add the indicator to your TradingView chart, set an alert for new trade boxes, and trade when the framework says conditions align.

Below, I’ll break down each of today’s setups and explain why they worked.

SPX 15m — Bearish Rejection at Higher Timeframe Levels

The first trade came during the London session. SPX pushed into the Prev Month High, but the higher timeframe bias was bearish.

That’s when the Framework printed a short box.

Entry: 6427.62

Stop: Above recent liquidity, at 6414.93

Targets: Pre-mapped below, 6396.83 / 6387.60 / 6372.20

This wasn’t about guessing. It was structure: HTF bearish, rejection at a major level, clean risk/reward.

EURUSD 15m — New York Session Breakout

During New York, EURUSD retested London Open before rejecting lower. The higher timeframe bias was bearish, and the Framework instantly printed a short box.

Entry: 1.16368

Stop: Above intraday high (1.16594)

Targets: Straight into Prev D Low (1.1622) and below

The result?

Targets hit without hesitation. The system kept you out of chop and into the trend.

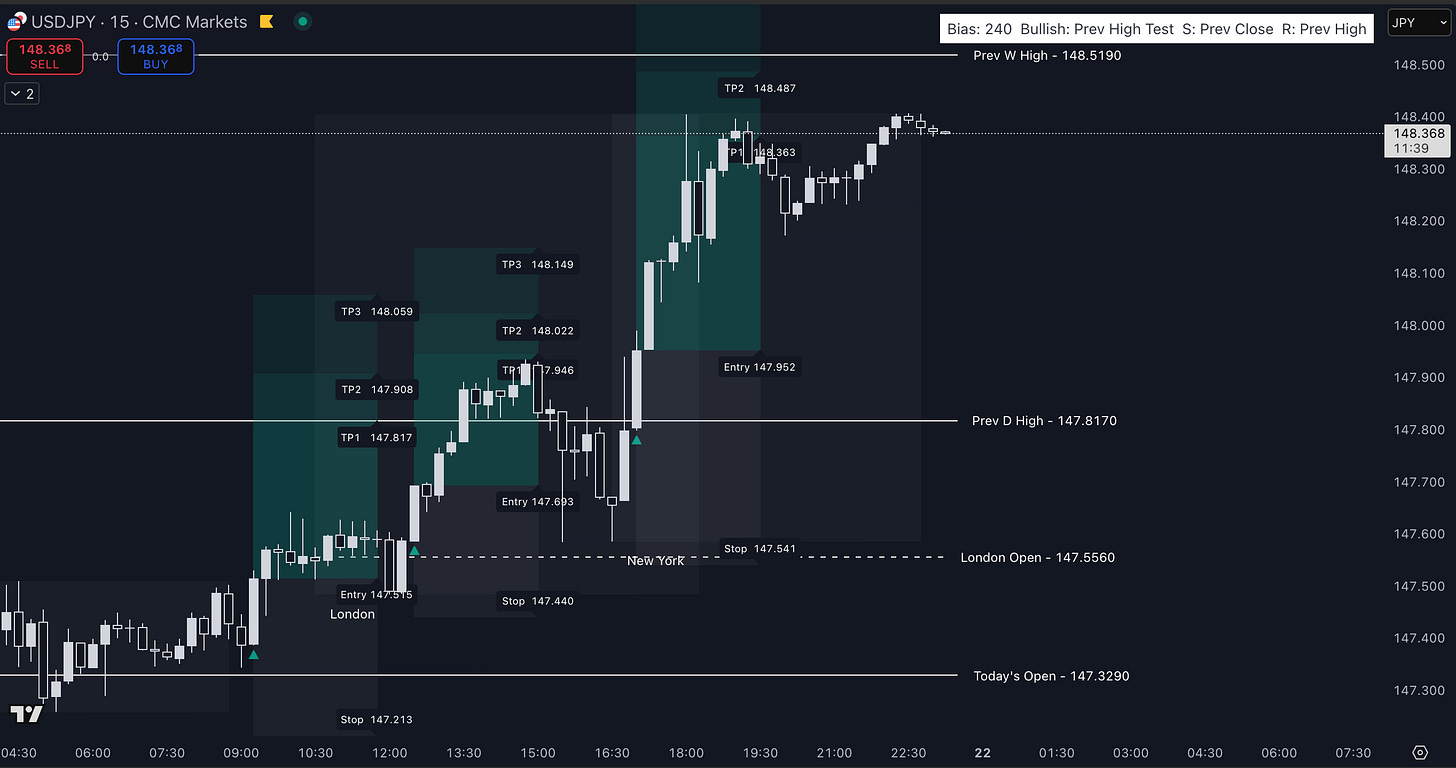

USDJPY 15m — Riding the Bullish Momentum

USDJPY gave two entries today, both in line with the bullish higher timeframe bias.

First, a breakout box during London session.

Then, confirmation with another entry during New York.

Notice how both entries aligned with Prev D High and NY Open — no random longs in the middle of nowhere.

The Framework kept printing bullish setups as long as bias + structure remained valid. That’s how you ride momentum, not fight it.

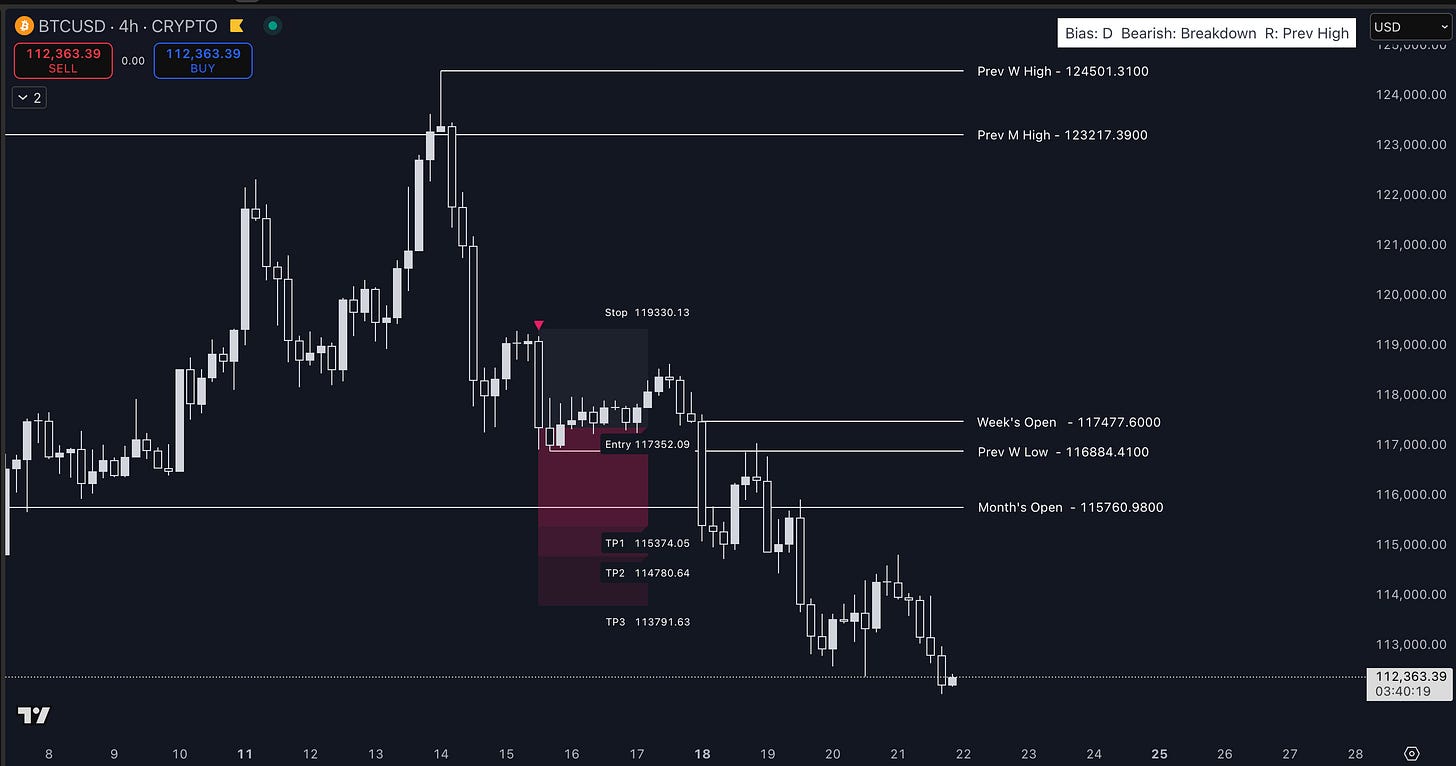

BTCUSD 4H — Daily Bearish Breakdown

BTC gave one of the clearest higher-timeframe trades today.

The daily bias was bearish. On the 4H, the Framework printed a short box after a retest of Prev W Low.

Entry: 117352.09

Stop: Above supply, at 119330.13

Targets: 115374 / 114780 / 113791

The trade mapped itself hours in advance, requiring zero guesswork.

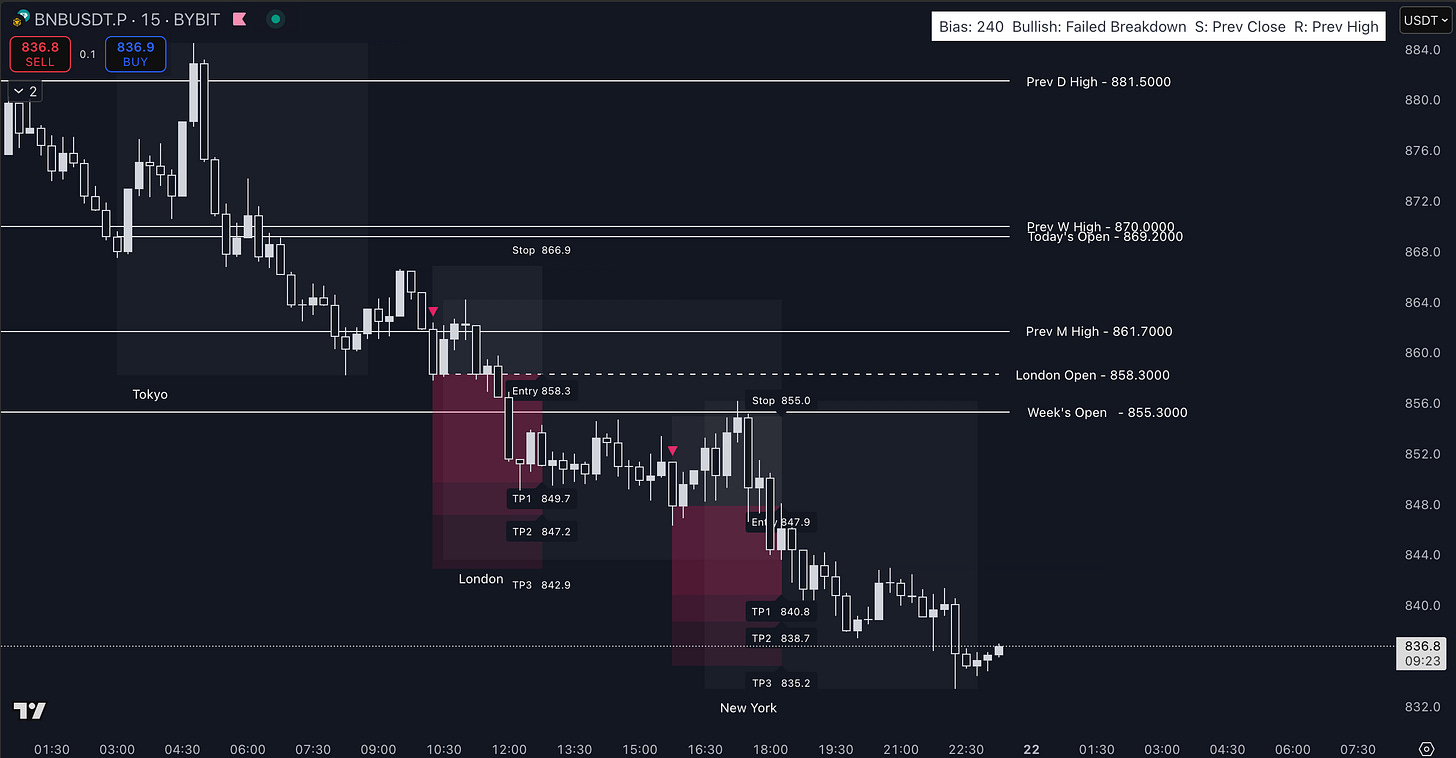

BNB 15m — Two Shorts, Two Clean Drops

BNB was another example of how the Framework handles intraday volatility.

London session printed the first short box right under Prev W High.

New York session gave another short rejection at London Open.

Both trades moved cleanly to targets, protecting stops tightly above recent highs.

This is where most traders overtrade. The Framework does the opposite: it gives you structure, then it stops printing boxes when no edge exists.

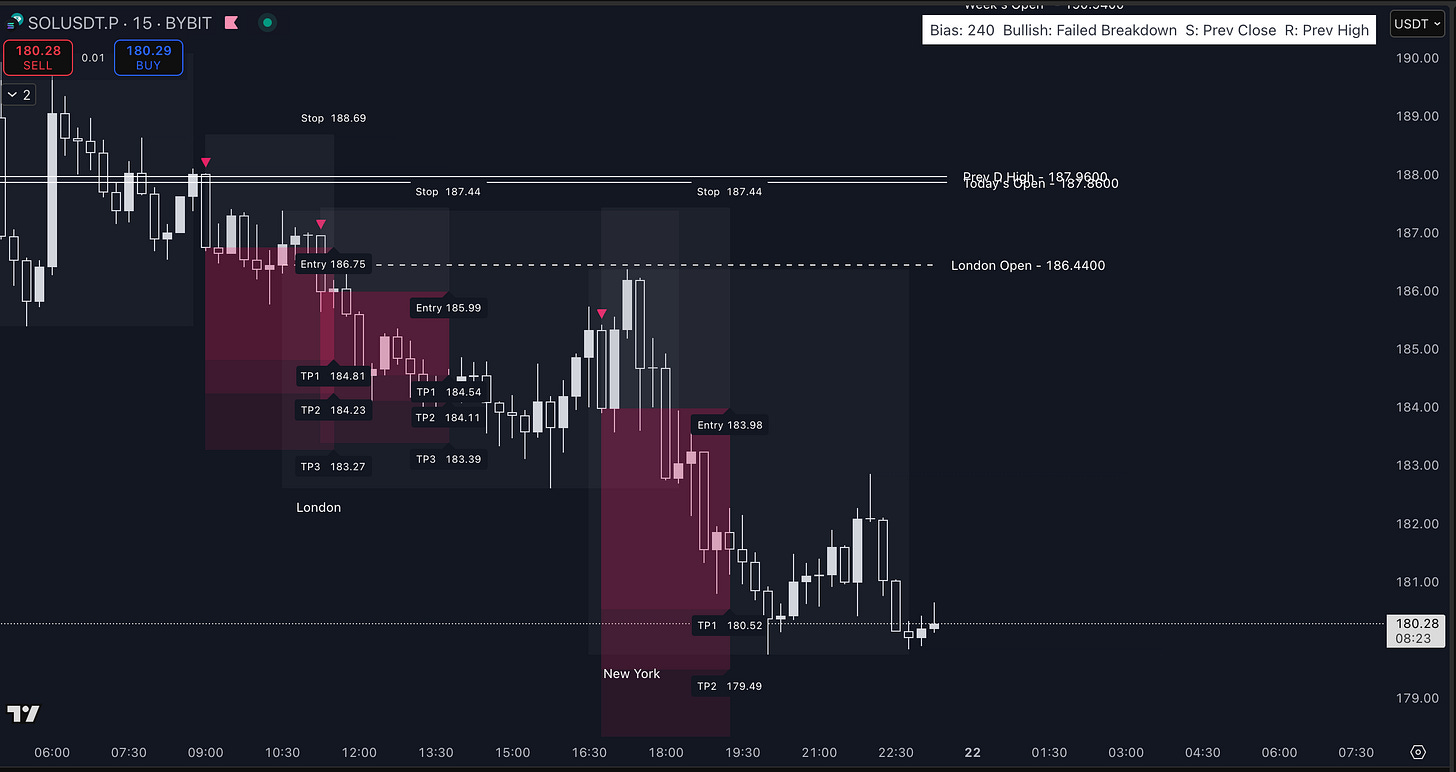

SOL 15m — Multiple Rejections, Clear Shorts

SOL was choppy early, but the higher timeframe bias remained bearish.

The Framework printed a first short at London Open, then another at New York rejection. Both protected stops right above highs, with three stacked targets below liquidity.

Instead of chasing candles, you had two clear opportunities to participate in the move lower.

Why This Matters

Notice the pattern?

Every trade was in line with HTF bias.

Entries were placed at key levels (Prev Highs/Lows, Session Opens).

Stops were automatically mapped above liquidity.

Targets were pre-defined, no guesswork.

This is how professional traders operate. The Black Tie Report Framework Pro automates it for you.

Trading isn’t about predicting every move. It’s about waiting for conditions to align and executing with discipline.

Today’s setups prove that with the right framework, you can trade across assets — indices, forex, crypto — with the same process.

No “gut feeling.”

No drawing 20 lines on your chart.

Just bias, structure, entries, and targets — printed automatically.

Want to Trade Like This?

The Black Tie Report Framework Pro is now available:

$47/month

$127/3 months (10% off)

$227/6 months (20% off)

$397/year (30% off)

Full access includes:

✔️ Premium TradingView indicator (zero setup)

✔️ Automated bias, levels, entries, stops, targets

✔️ Premium Discord with tutorials & 1:1 support

✔️ Lifetime updates

Trade with structure, not noise.