Most traders waste time staring at the wrong charts, in the wrong session, chasing setups that were never meant to happen.

They open BTC at 2 a.m. expecting movement.

They stare at SPX during London.

They wonder why Gold is dead after NY closes.

It’s not that their strategy is broken.

It’s that their asset selection doesn’t match the session.

This article breaks down exactly which assets I trade in each session — and why.

✅ First Principle: You Trade the Session, Not Just the Chart

Every asset has a time of day when it behaves best:

Cleaner structure

Tighter execution

Stronger follow-through

That behaviour is driven by liquidity — and liquidity is driven by which markets are open.

If you want consistency, your edge starts here:

Match the asset to the session.

🔍 My Preferred Assets per Session

✅ London + New York Overlap

📅 Time (UTC): 12:00–16:00

🧠 Why: Peak global liquidity. Trends accelerate. Traps resolve. HTF bias confirms.

Trade:

XAUUSD (Gold)

XAGUSD (Silver)

These two dominate during overlap. Gold especially respects structure during this window, offering:

Fast 2–3R setups

Clean pullbacks into zones

Breakouts aligned with bias

If you trade metals, this is your prime time.

✅ London Session

📅 Time (UTC): 07:00–11:00

⚙️ Why: Precision. Structure. Early volatility. Smart money moves first here.

Trade:

EURUSD, GBPUSD, USDJPY

EURGBP, EURJPY, GBPJPY

USDCHF

DAX (Germany 40)

(Optionally FTSE100)

London session is where European FX pairs and indices create structure:

CHoCH/BOS sequences are clean

Session highs/lows are respected

Institutional levels (weekly/monthly) get tested and defined

DAX in particular offers:

Sharp open

Range development

One clean directional leg before NY

✅ New York Session

📅 Time (UTC): 13:30–20:00

🔥 Why: Momentum. Macro. Volatility spikes. News reactions.

Trade:

SPX, NAS100, US30

UKOIL (Crude)

BTC, ETH, SOL, BNB, LINK

DXY (for context only)

NY is all about reaction + continuation:

CPI, FOMC, NFP drops = trend accelerations

Indices break levels cleanly

Crude often runs in 1–2 leg impulses

Crypto correlates with tech and follows macro tone

If your strategy likes volatility, this is your session.

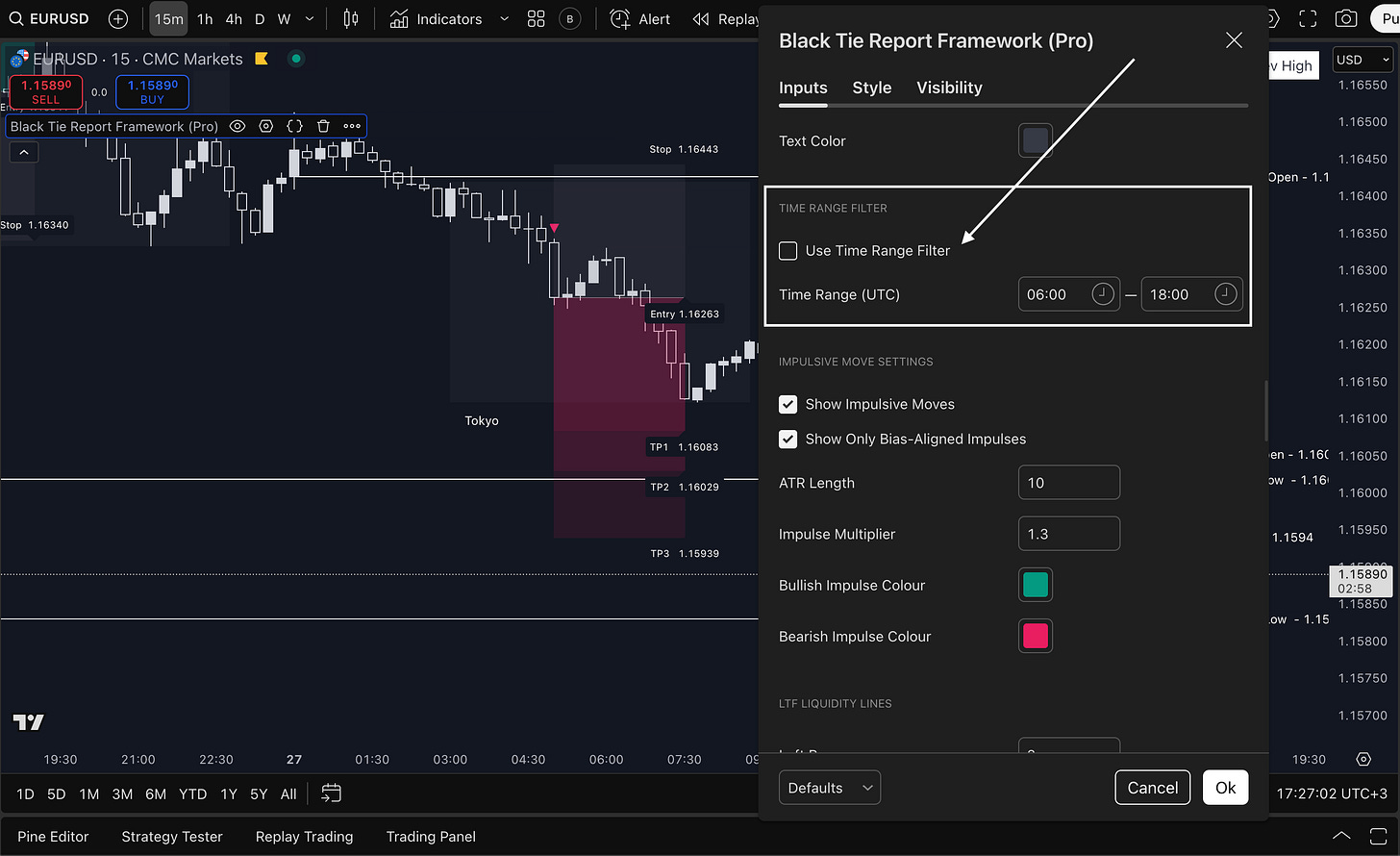

🕰️ The Framework’s Time Range: Why 06–18 UTC?

By default, the Black Tie Report Framework sets the active session between 06:00 and 18:00 UTC.

That’s intentional.

This window captures:

London open

NY open

London-NY overlap

And filters out low-quality zones (Asia close, post-NY chop)

90% of fakeouts and dead zones happen outside this range.

You can modify this window — but if you want:

Real liquidity

Valid structure

Fewer false signals

Then 06–18 UTC is the most efficient slice of the day.

Customize Your Session Range

The Framework lets you adjust your session window:

Want only London? Set 06:00–11:00

Prefer NY only? Set 13:00–20:00

Scalp Asia? Use 00:00–05:00

And it adjusts:

Session highs/lows

Levels respected

Trade boxes drawn

✅ You define your time edge.

✅ The Framework handles the rest.

Final Thoughts

Most traders lose not because they’re bad — but because they’re early, late, or in the wrong chart at the wrong time.

If you’ve ever felt like:

Price respects nothing

Your bias is right but entries fail

The market always whipsaws you

The fix isn’t more signals.

It’s better structure + better timing.

Start with the right asset.

Match it to the right session.

Let the Framework do the rest.

📲 And follow live setups + breakdowns:

See you in the next update.