The Fantasy of the Next “100x”

If you spend enough time on Twitter, Telegram, or YouTube, you’ll notice a recurring pattern. Every week, a new wave of accounts promise you they’ve found “the next big thing.”

“This altcoin is going to the moon.”

“This micro-cap will 100x by next quarter.”

“This is the trade that will change your life.”

It’s always packaged in the same style: dramatic language, flashy charts, rocket emojis, and fake urgency. And people fall for it. Why? Because the idea of getting rich fast is infinitely more exciting than the boring, disciplined reality of what trading actually requires.

But here’s the truth: chasing the next 100x move isn’t trading. It’s gambling. And like every form of gambling, the house always wins.

The Mathematics of Fantasy

Let’s strip away the hype and look at the numbers.

How many coins or assets really go 100x? A handful in a decade. And most of those are hindsight cherry-picks — highlighted after the fact by the same accounts that conveniently “called it.”

So you buy 20 random coins hoping to find the one. Nineteen go to zero, one goes 5x. What happens? You still end up negative.

This is the dirty secret of “moonshot culture”: the odds of catching a life-changing move are statistically indistinguishable from buying a lottery ticket. And just like lottery winners, even if you get lucky once, the chances you’ll keep the money are slim.

Why? Because the problem isn’t the trade. The problem is the lack of structure.

The House Always Wins

Casinos don’t need to win every hand. They don’t need the jackpot. They need two things: probabilities and discipline.

The math is always on their side, because every game has a slight edge tilted toward the house. Over thousands of plays, the edge compounds.

Now compare this with trading. Most retail traders behave like gamblers: chasing pumps, following signals blindly, overleveraging after small wins. They try to be the lucky one.

Professionals behave like the house. They don’t need to be right all the time. They don’t need the jackpot. They need to preserve capital, manage risk, and let probabilities play out.

That’s why the casino wins. And that’s why most retail traders lose.

The Reality of Professional Trading

When you study traders who survived decades in the markets, the pattern is clear:

Paul Tudor Jones: openly admitted he’s wrong most of the time, but manages risk so he lives to fight another day.

Ed Seykota: legendary futures trader with a win rate below 50%, but strict discipline turned him into one of the greatest.

Richard Dennis and the Turtles: proved that even complete beginners can become profitable traders with a system and rules, despite only ~40% win rates.

Notice the theme? Not one of them was waiting for a “100x moonshot.” They weren’t gambling. They were following structure.

The Myth of Hard Work

Another illusion spread on social media is that trading must be incredibly hard. The advice goes like this:

Only trade between 9:00–9:30 or 14:00–15:00.

Document every single trade in multiple journals.

Memorize endless acronyms and jargon.

Spend 12 hours a day glued to charts.

In short, make your life miserable, because apparently misery equals discipline.

But here’s the problem: none of that guarantees profitability. In fact, most people burn out long before they see any progress. Hard work isn’t the edge. Discipline is.

Simplicity Wins

What if trading could be reduced to a few clear rules?

Risk a maximum of 1% per trade.

If you lose three trades in a row, stop trading for the day.

Let winners run, but take partial profits at pre-defined targets.

Cut losers fast.

That’s it. Nothing mystical. Nothing exhausting. No need for 20 different screeners or 10 hours of chart-marking every morning.

Trading is not about working harder. It’s about working smarter.

Automation Changes the Game

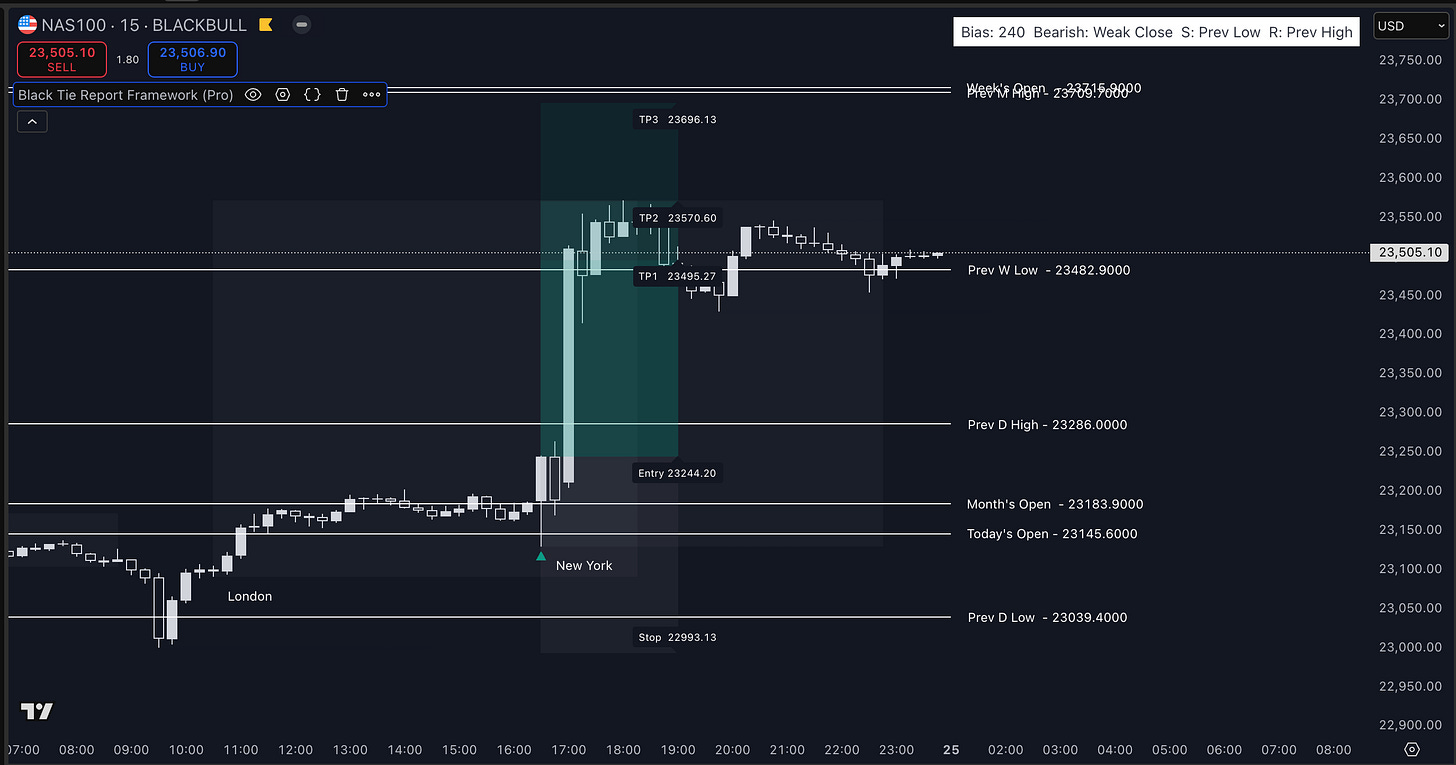

This is exactly why we built the Black Tie Report Framework Pro. Not to give “signals.” Not to sell lottery tickets. But to automate the parts of trading that can and should be automated:

Bias: automatically aligned with higher timeframes.

Structure: major highs, lows, opens, and liquidity mapped instantly.

Entries/Stops/Targets: smart trade boxes print only when conditions align.

Filtering: noisy setups near key levels are automatically removed.

Alerts: so you never have to stare at screens waiting.

In other words: all the complexity, jargon, and “hard work” social media tells you to do is handled automatically.

Your only job is the part no one can automate: discipline.

Trading Without Fairy Tales

So let’s be brutally honest.

If you’re spending your time chasing the next 100x, you’re not trading. You’re gambling. And you will be the rule, not the exception. Over 90% of people who approach markets this way lose money.

But if you stick to a simple strategy with clear risk/reward, and you let automation handle the heavy lifting, your odds improve dramatically. Because now you’re no longer chasing fairy tales. You’re playing the math game.

And the math game is the only one that works in the long run.

Why Most People Will Never Get This

The reason why “moonshot” culture dominates social media is simple: it’s easier to sell excitement than discipline.

“Buy this coin, it will 100x!” gets engagement.

“Risk 1% and stop after 3 losses” doesn’t.

But what do you want — engagement or results?

Do you want dopamine spikes from tweets, or consistent growth in your account?

The two are not the same.

The Black Tie Approach

At Black Tie Report, we don’t sell fairy tales. We don’t tell you to work like a slave to “earn discipline.” And we definitely don’t tell you to chase 100x fantasies.

We focus on what works:

Clear structure

Automated analysis

Risk control

Discipline

That’s it. Boring? Maybe. Profitable? Definitely.

Stop Buying Lottery Tickets

If you’ve been chasing moonshots, stop. The math is not on your side. You will lose.

If you’ve been overworking yourself, thinking effort equals profitability, stop. The market doesn’t pay you for effort. It pays you for discipline.

Trade with structure. Automate what can be automated. Focus on risk, not fantasies. That’s how you give yourself a chance to be among the few who win consistently.

Have a nice weekend.