If you're reading this, chances are you’ve heard about the Black Tie Report Framework and are wondering how to get started. The good news? It’s far simpler than you might think. In fact, we’ve designed everything to be as beginner-friendly as possible — while still offering powerful features for more advanced users.

Here’s a complete walkthrough.

🛒 Step 1: Get Access

Whether you're just testing for a month or ready to commit longer-term, the first step is to purchase the Framework from our official store:

Monthly plan: $47/month

Long-term plans: Save up to 30% if you choose 6 or 12 months

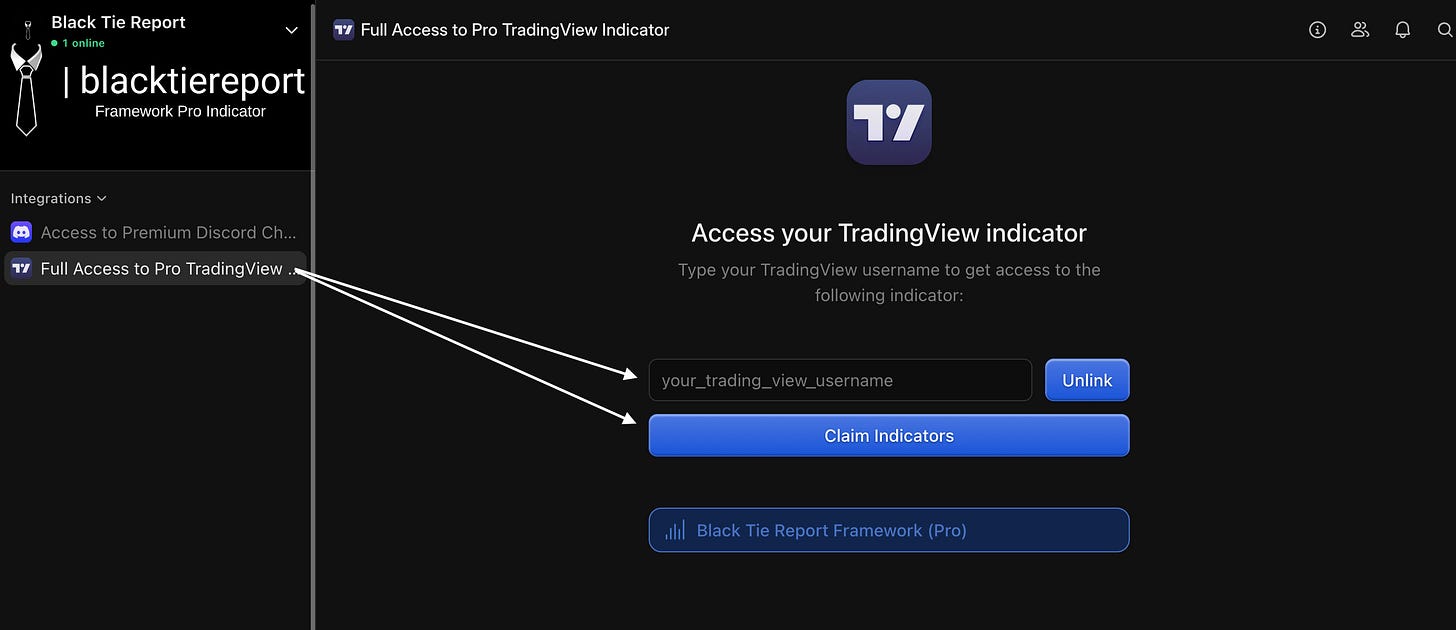

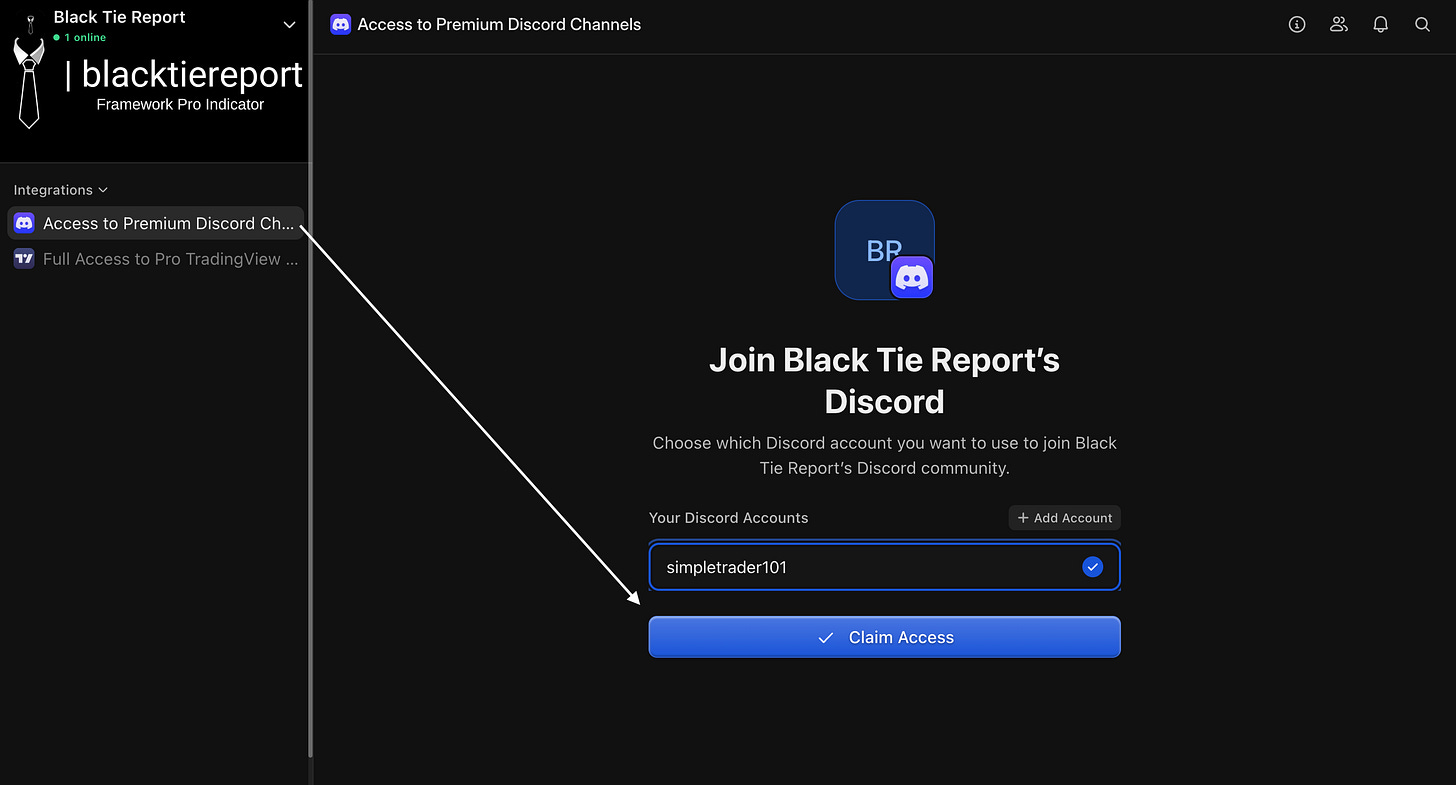

Once you select your plan and enter your payment details, you’ll be asked to connect your TradingView account (to access the indicator) and your Discord account (to join our private server for support, tickets, and updates).

📈 Step 2: Add the Indicator to Your Chart

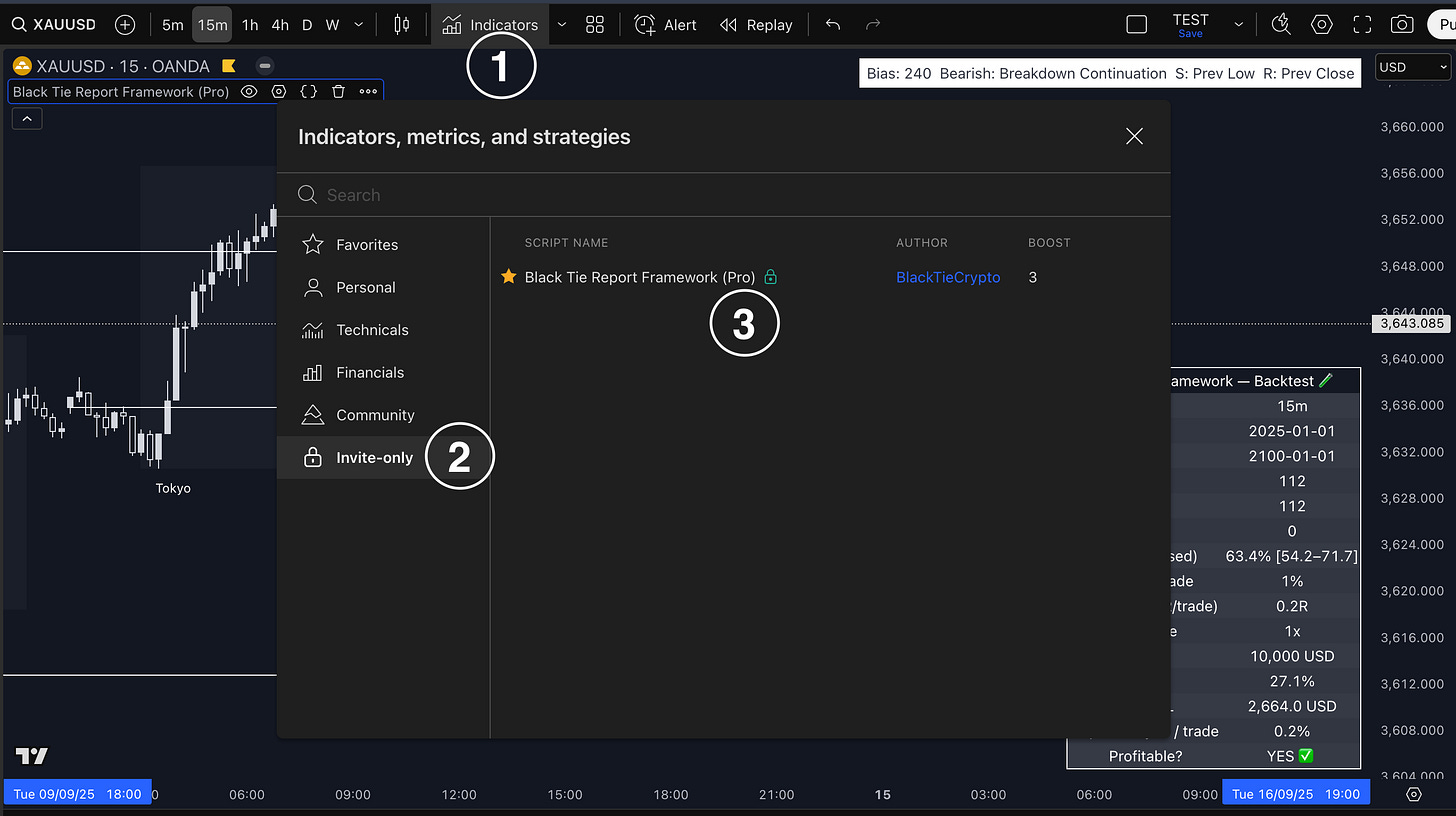

Once your TradingView access is approved (it happens instantly), go to your chart and:

Click on the Indicators menu

On the sidebar, click Invite-Only Scripts

Locate Black Tie Report Framework Pro and click to add it to your chart

You’ll now see the Framework visualized directly on your chart. The indicator works out of the box — there’s no setup required to start using it.

🔔 Step 3: Set Your Alert (Only One Needed)

This is where things get even easier.

The Framework is designed to require just one alert per chart and timeframe. To receive notifications when a new trade is suggested:

Click the three dots on the indicator name

Select Add Alert on Black Tie Report Framework Pro

Click Create (no need to change any default settings)

Even with a free TradingView account (which limits the number of alerts), you’ll be fine — the Framework needs only one alert per setup.

⚙️ Step 4: Understand the Settings (Optional)

The default configuration is already optimized for every asset and timeframe — including 1m, 5m, 15m, 1H, 4H, Daily, and Weekly.

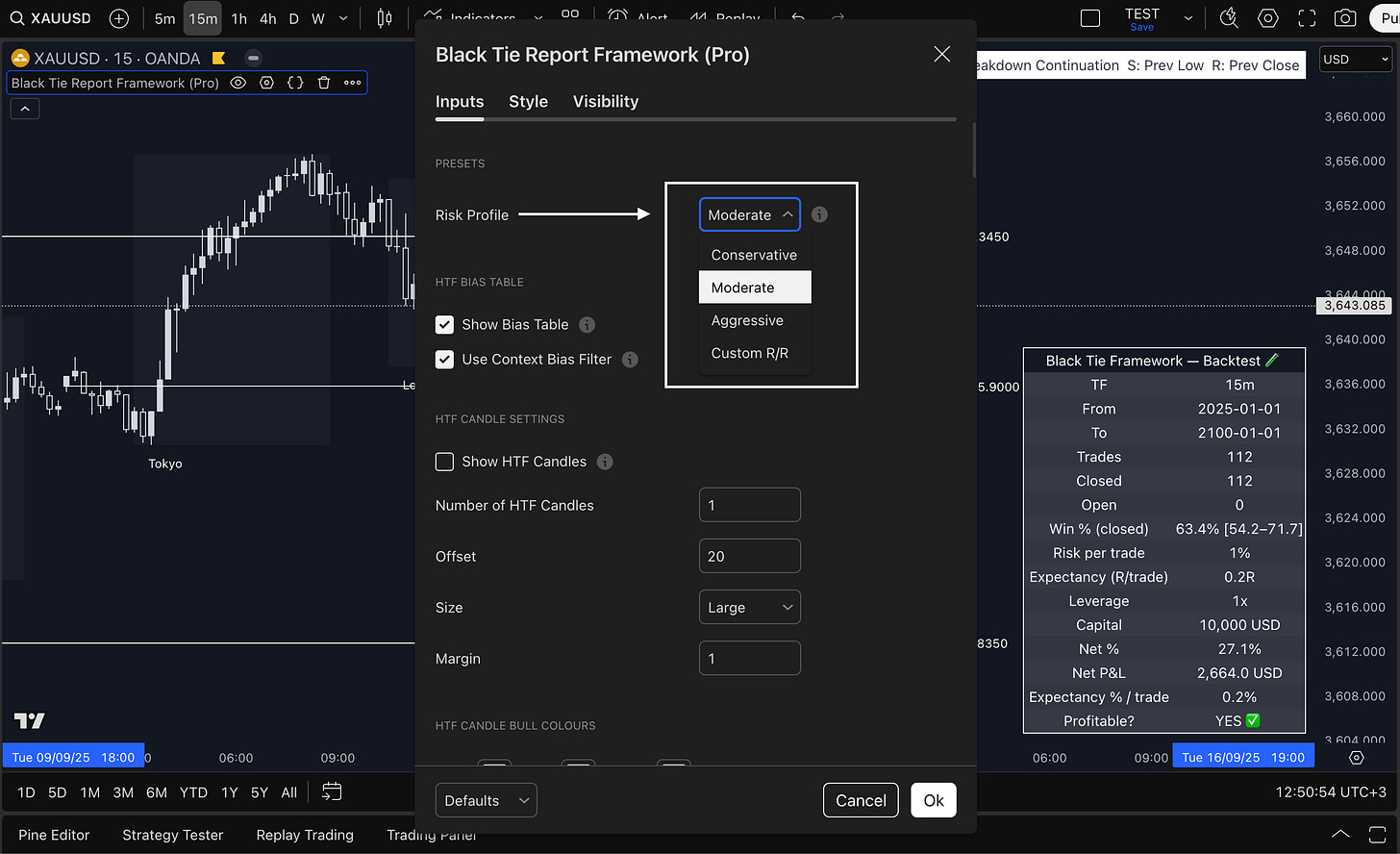

But if you want to tweak it, the new UI is clean and intuitive.

You’ll start by selecting your Risk Profile:

Conservative

Moderate (recommended default)

Aggressive

Or set your Custom Risk/Reward ratio

Everything else — like higher timeframe candles, key levels, session boxes, and chart colors — is clearly explained via tooltips in the interface.

Our advice: unless you know exactly what you're doing, leave everything as it is. The Framework is already optimized to give high-probability setups.

⏱ Recommended Timeframe: 15 Minutes

While the Framework works across all timeframes, our backtests show the 15-minute chart consistently delivers the most balanced performance in terms of win rate and ROI.

You’re free to experiment — but if you’re unsure, start on 15m.

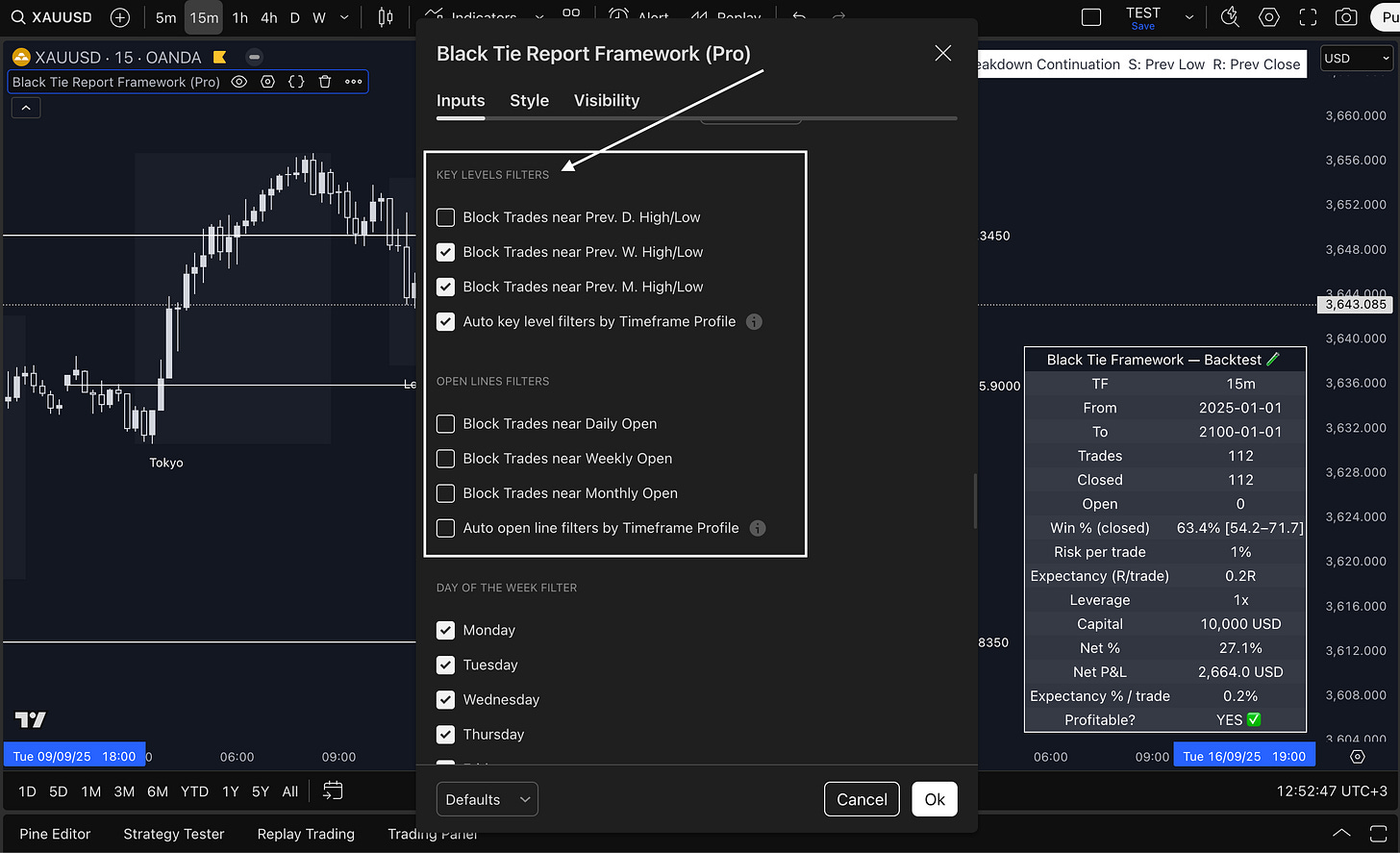

🛡️ Built-In Risk Filters

By default, the Framework filters out trades that conflict with key price levels — like entering long right below a weekly high, or short right above a weekly low.

These filters prevent setups near dangerous areas, and they’re already active when you load the indicator. You don’t need to configure them — unless you want to override them for testing.

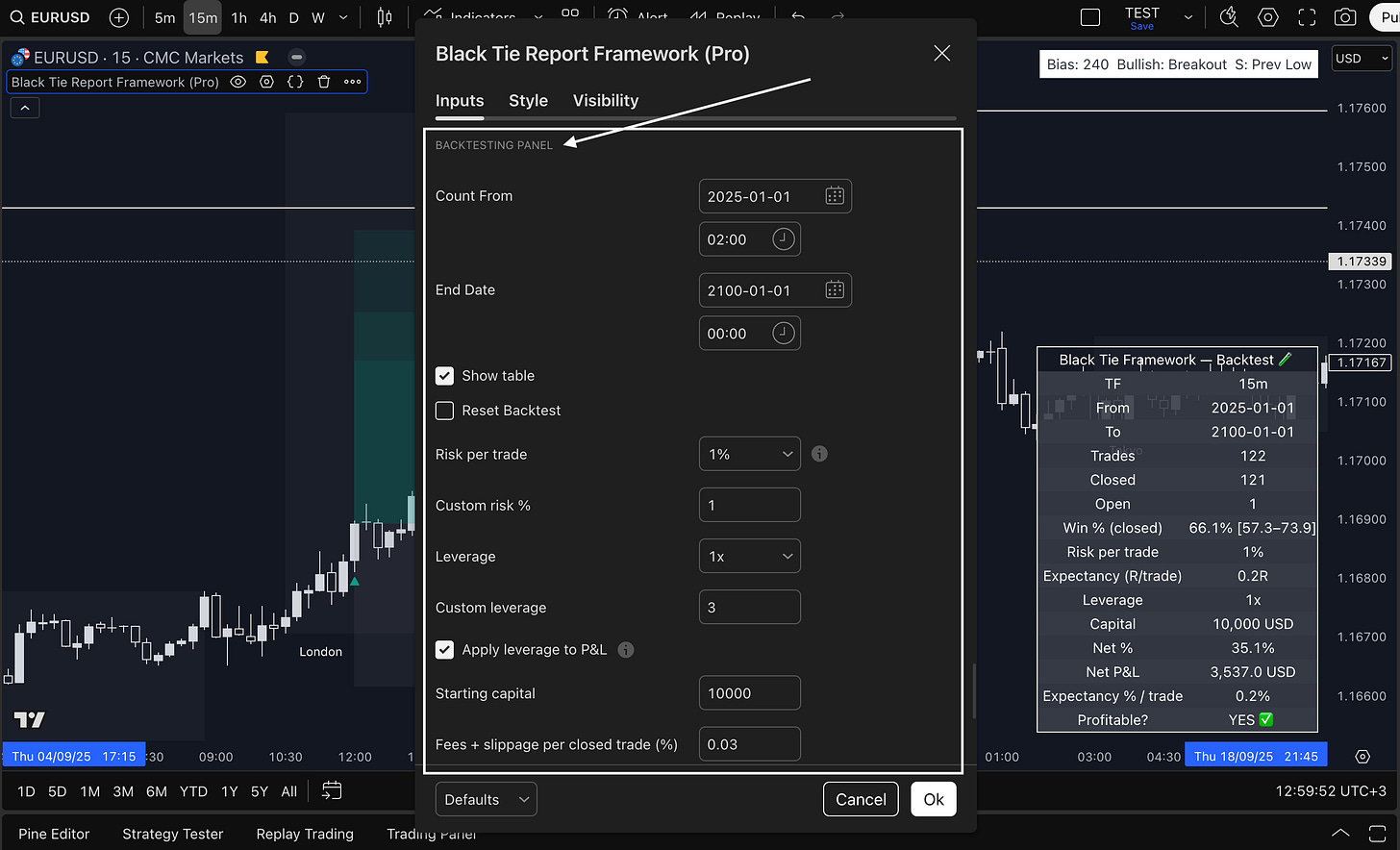

💰 Manage Your Risk

All the strategy logic is handled by the Framework.

Your only job is to manage your risk.

We strongly recommend:

Risking no more than 1% per trade

Avoiding excessive leverage (3x to 10x max, depending on asset)

Thinking in probabilities, not guarantees

The Framework only prints a suggested trade when everything aligns. So if you stay consistent and disciplined with risk, the math works in your favor.

⚡ Universal Automation Module (Optional)

If you want to go one step further, the Framework includes a Universal Automation Module — which allows you to send webhook alerts directly to your exchange or broker.

It works with:

Crypto platforms

Forex brokers

MT4 / MT5

Anything that accepts webhook automation

To automate trades:

Contact your platform or broker and generate an API key

Use the Webhook URL provided by them

Paste the Webhook URL into your TradingView alert

That’s it. We’ll be releasing tutorials on this soon, but it’s already functional and live.

🔁 Other Features

You’ll also find:

Backtest panel — select a date range and simulate results

Alert Engine options — to be notified on TP/SL hits or bias changes

Customizable chart visuals — session boxes, colors, levels

Advanced risk filters — for power users who want to fine-tune

Even if you use none of these features, the Framework still works just by adding it to your chart and setting your alert.

✅ Final Thoughts

The Framework was built to simplify trading.

It gives you structured, clean entries.

It filters out low-probability setups.

It saves you time, stress, and second-guessing.

Whether you’re a beginner or someone looking to reclaim their time from constant chart watching — you now have a tool that does the heavy lifting for you.

If you need help, open a support ticket inside Discord. And stay tuned — more updates are on the way.

—

Black Tie Team