How the Black Tie Framework Performed on NFP + Unemployment Rate Day

A professional breakdown of trade performance across Forex and Indices using real-time entries, structure-based execution, and fully quantified setups.

Friday, September 5, 2025.

The day of the Non-Farm Payrolls (NFP) and US Unemployment Rate reports — two of the most impactful economic releases for USD-related assets.

These events are notorious for creating volatility, fakeouts, and sharp reversals. For most traders, it’s a dangerous day to trade. But for those using the Black Tie Report Framework, the story was different.

In this report, we’ll analyze how the Framework handled the NFP session, the quality of each trade suggested by the system, and what the backtesting module confirms about the strategy’s performance over time.

We’ll also discuss the time-saving value of this tool for people who want to simplify their execution while maintaining consistency and discipline.

Market Context: NFP and the USD Impact

At exactly 15:30 UTC, three red folder events dropped:

Non-Farm Payrolls: Actual 22K vs Forecast 75K (a major miss)

Unemployment Rate: Rose to 4.3%

Average Hourly Earnings: Below expectations

The result? A massive spike in volatility across major USD pairs and indices. These events can invalidate setups, trigger liquidity grabs, and create false breakouts — unless your strategy is designed to filter structure, session timing, and key levels, like Black Tie does.

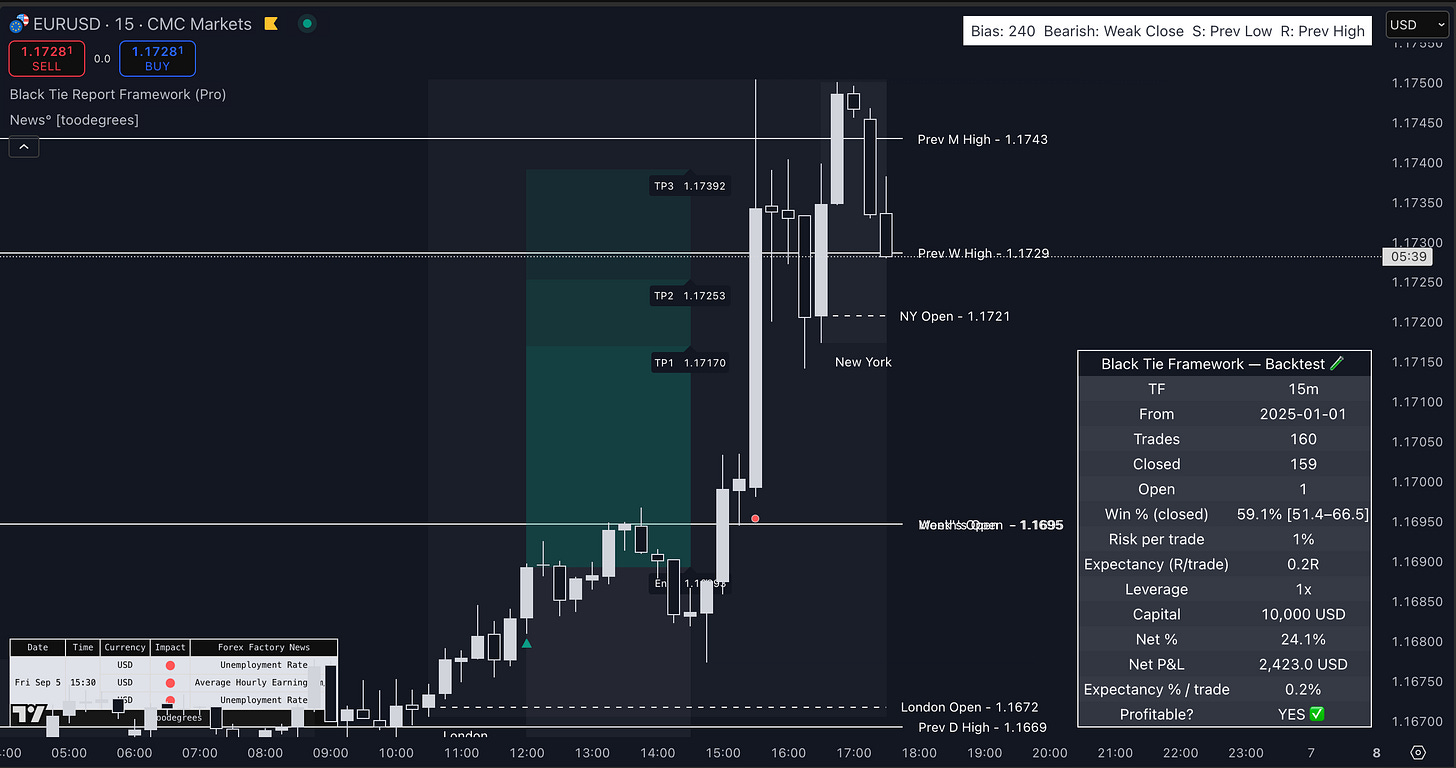

EURUSD – Bullish Continuation from London into NY

Entry: Break of structure and continuation above previous week’s high

Session: New York open (post-London consolidation)

Despite the news volatility, the Framework identified a valid long setup after a clean structure break to the upside.

Entry: 1.1713

TP1, TP2, TP3: Hit in succession by 16:00 UTC

News Impact: Favorable to EUR given weak USD data

Backtest Module Data (15m):

160 trades since Jan 1

Win %: 59.1%

Net return: +24.1% (spot, no leverage is applied on the calculation)

Expectancy: +0.2R/trade

Risk per trade: 1%

Net P&L (10k): $2,423

This trade followed the textbook sequence of:

Structure confirmation post-news

Liquidity sweep of London low

Clean continuation through NY Open

NAS100 – Clean Breakdown After Early Fake Rally

Entry: Rejection of previous week high and NY Open

Session: New York, post-news impulse

The Framework printed a short setup after price failed to hold the London support zone. The entry occurred at 23,713.70, with a stop above the rejection wick, and all 3 TPs hit with precision.

Entry: Short at NY Open rejection

TP3: Cleared 23,442.41 within 45 minutes

Risk: 1%

Volatility: Smooth breakdown without chop

Backtest Module Data (15m):

186 trades since Jan 1

Win %: 62.4%

Net return: +40.1% (no leverage)

Expectancy: +0.2R/trade

Net P&L (10k): $4,042

This setup was a model example of:

NY reversal following early fake rally

Structure + session confluence

Volume acceleration confirming the move

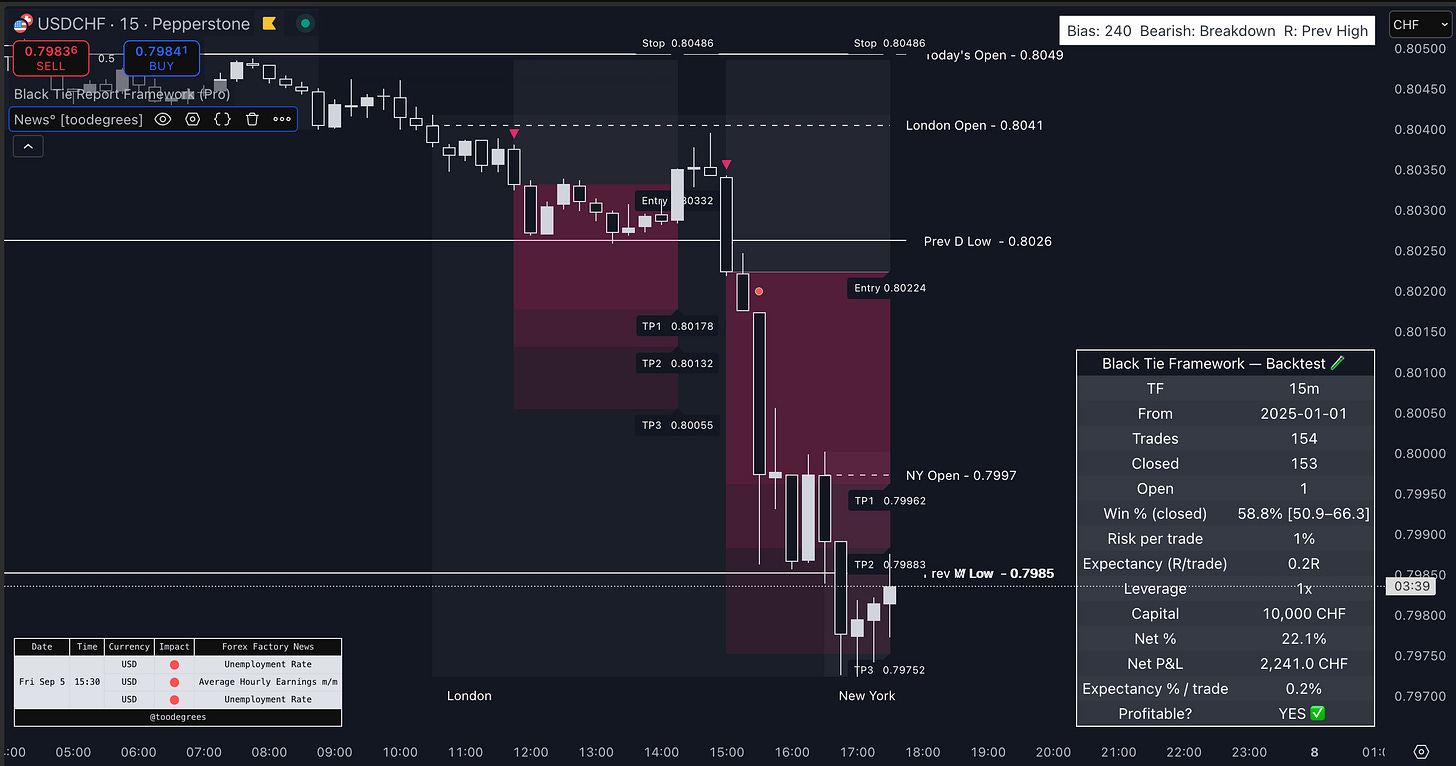

USDCHF – Double Setup, Double Win

Session: New York

Conditions: Clear rejection at London open + weak USD data

The Framework triggered two consecutive short trades:

First entry: 0.80332 (failed continuation)

Second entry: 0.80224 (post-news breakdown)

Both hit all 3 TPs. These trades occurred after liquidity grabs around the daily low and validated the session filter logic.

Backtest Module Data (15m):

154 trades

Win %: 58.8%

Net Return: +22.1% (spot)

Expectancy: +0.2R/trade

Net P&L: $2,241

GBPUSD – Failed Breakout, Reversal to TP3

Entry: 1.34646

Conditions: Rejection at London high + weak USD confirmation

This trade was unique because it looked like a fakeout at first — but price respected the high, showed a strong 15m close rejection, and the Framework printed the short.

Stop: 1.34464

TP3: 1.34974

Execution: Clean impulse after NY Open

Backtest Module Data (15m):

167 trades

Win %: 61.7%

Net Return: +34.1% (spot, no leverage)

Net P&L: $3,399

What This Means: Structure > News

All trades shown above were printed after the news spike, once structure was confirmed.

There was no need to predict the news — the Framework waited for confirmation, order flow alignment, and key level rejection.

It’s the combination of:

Session timing (London, NY)

Price structure (Breakouts, Failed Breakouts, Liquidity sweeps)

SL/TP zones based on impulse size

That creates this level of accuracy.

About the Backtests

All screenshots include real historical trades taken by the strategy, with the following default parameters:

Account size: $10,000 (or equivalent)

Risk: 1% per trade

Leverage: None (1x only)

To adjust these to your capital:

$1,000 with 10x leverage = same as $10,000 at 1x

If you use 2% risk and 5x leverage → multiply P&L by 10

The system doesn’t rely on leverage, but adapts to it.

Save Time, Save Money, Trade Better

Let’s assume you spend 2 hours per day analyzing charts manually:

That’s 10 hours/week

40+ hours/month

At just $10/hour, that’s $400/month of your time

Now imagine that instead:

You set 1 indicator on your chart

You receive alerts with fully structured trades

You get SL/TP levels, backtest stats, session filters

All you do is review and execute

Black Tie Framework costs $47/month.

You save:

30+ hours/month

Mental energy

Cognitive mistakes

And gain:

Discipline

Clarity

Real data

Final Words

NFP is usually chaos. This time, it was clarity.

If you want to trade less, stress less, and earn more with structure — join the traders using Black Tie Framework every day.