How Structure Guides Execution Across Markets

Using the same logic to trade metals, crypto, and altcoins, all through one consistent framework.

There’s a pattern behind good trades.

But it’s not price.

It’s not an indicator.

And it’s never someone’s prediction.

It’s structure: the way markets move, pause, and break. The Black Tie Report Framework Pro is built around this idea. And when you use it correctly, execution becomes mechanical.

This article walks through four live examples across different assets — gold, altcoins, and majors — all traded using the exact same logic.

Why Structure Wins

Markets change.

Conditions shift.

Volume, volatility, sentiment — none of it is static.

But structure? Structure always speaks first.

That’s why this Framework doesn’t rely on indicators, volume spikes, or news. It tracks:

Daily bias, based on price action

Session-based key levels

Break of structure (BOS) and change of character (CHoCH)

Clean entries after liquidity events

TP and SL zones derived from fractals and recent PA

What you’ll see in this breakdown isn’t hindsight. These trades were taken using real-time signals generated by the Framework.

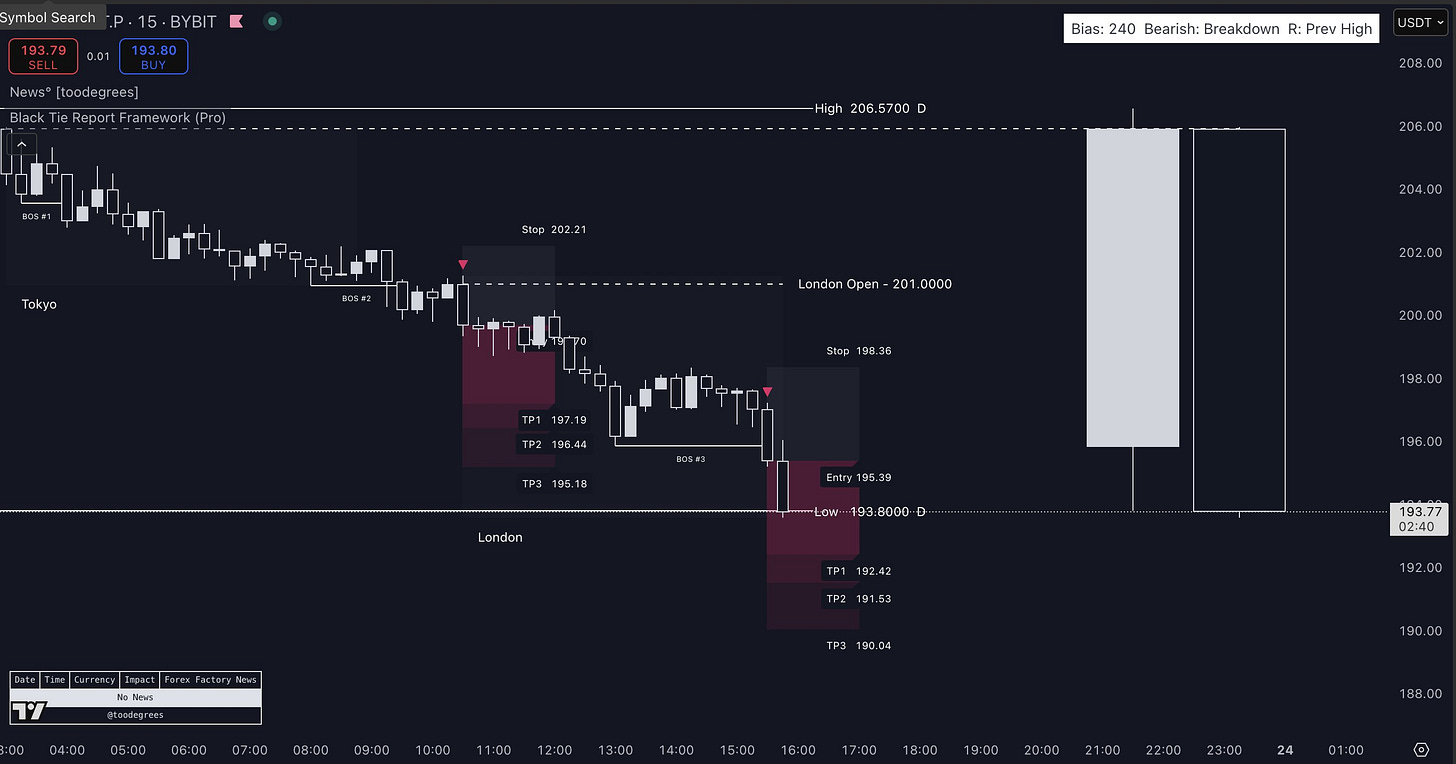

📍Example 1: SOLUSDT — Structure Breakdown in Moderate Mode

SOLUSDT was in a Moderate mode — not aggressive, but still directional. The Framework identified a bearish breakdown during London session, with BOS3 confirming the continuation.

Key Elements:

The day opened near a key range high

First liquidity sweep happened during Frankfurt

Confirmed BOS with strong body close

Entry triggered after structural retest

TP1, TP2, and TP3 reached without re-entry

This wasn’t about chasing. It was about letting the structure develop, then executing based on predefined rules.

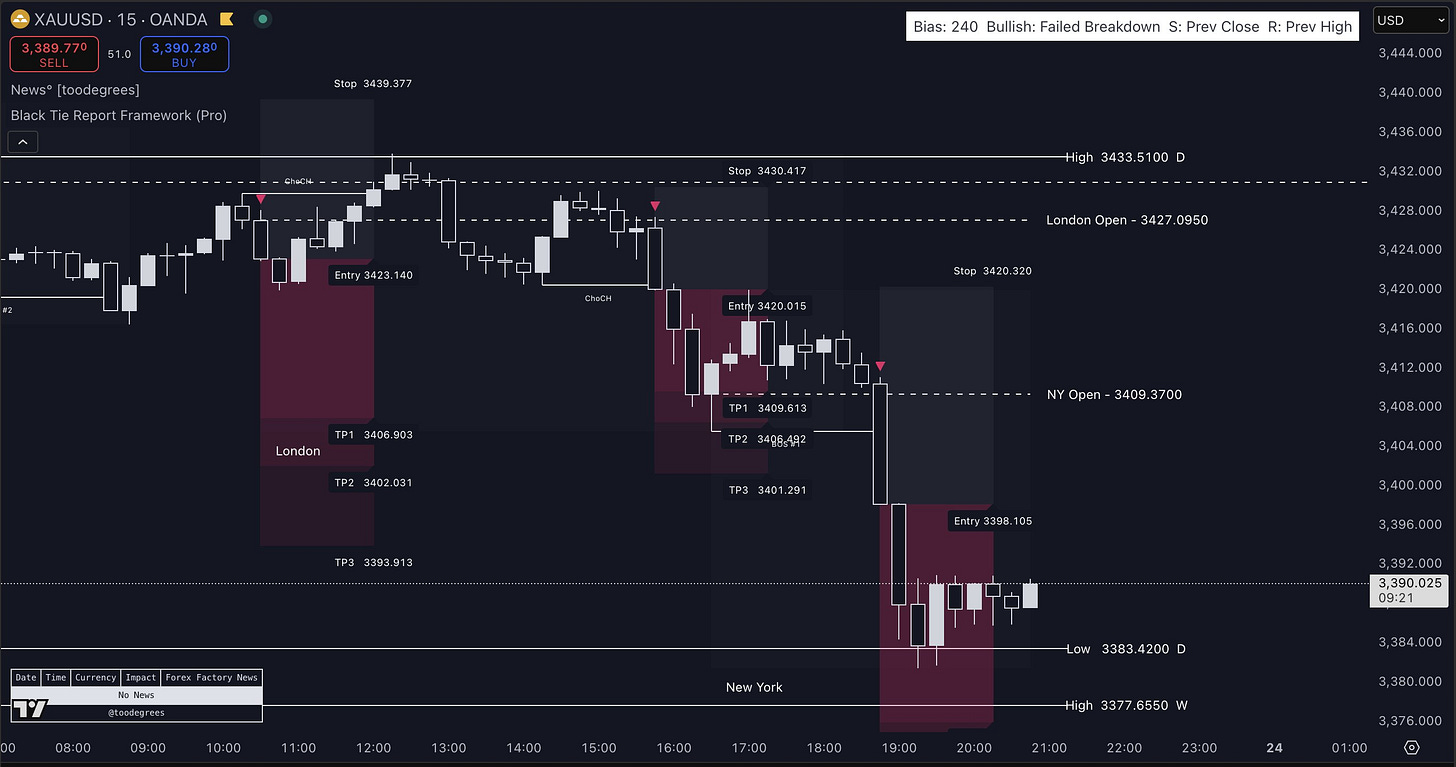

📍Example 2: XAUUSD — Same Day, Two Opportunities

Gold is known for volatility, but the Framework handles that by tracking bias transitions cleanly.

Trade 1: Bearish Breakdown

This setup developed early in the day, showing a clear rejection at previous liquidity zones. Structure gave:

BOS + rejection candle combo

Entry during London

Quick TP1 and TP2 before a slowdown

Trade 2: Bullish Failed Breakdown

Later today, a failed breakdown was identified by the Framework. This is one of the most powerful continuation filters:

Price swept below the range low

Closed back inside with strength

New CHoCH identified, confirming shift

Entry retested breakout zone

All TPs reached with minimal drawdown

The fact that both setups occurred on the same chart, same day, shows the Framework adapts to price, not prediction.

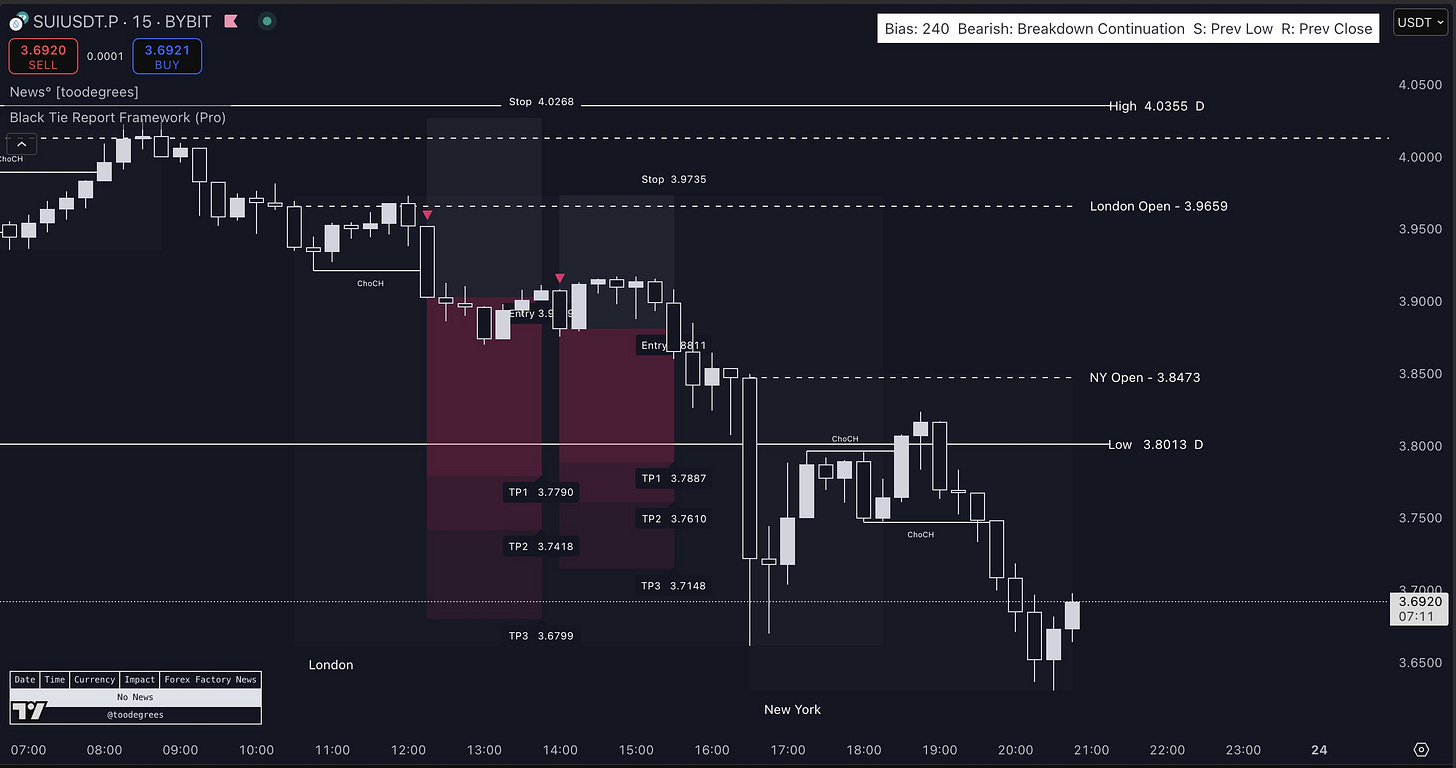

📍Example 3: SUIUSDT — Continuation Made Simple

Some trades are simple because structure makes them obvious.

This was one of those.

SUI had a clean bearish continuation after failing to reclaim the previous high. The Framework mapped:

CHoCH confirmed during pre-London

BOS after liquidity sweep

Clean retrace → entry zone marked automatically

TP1, TP2, TP3 hit during NY

No clutter. No second-guessing.

The entire setup came down to tracking bias + structure + session timing.

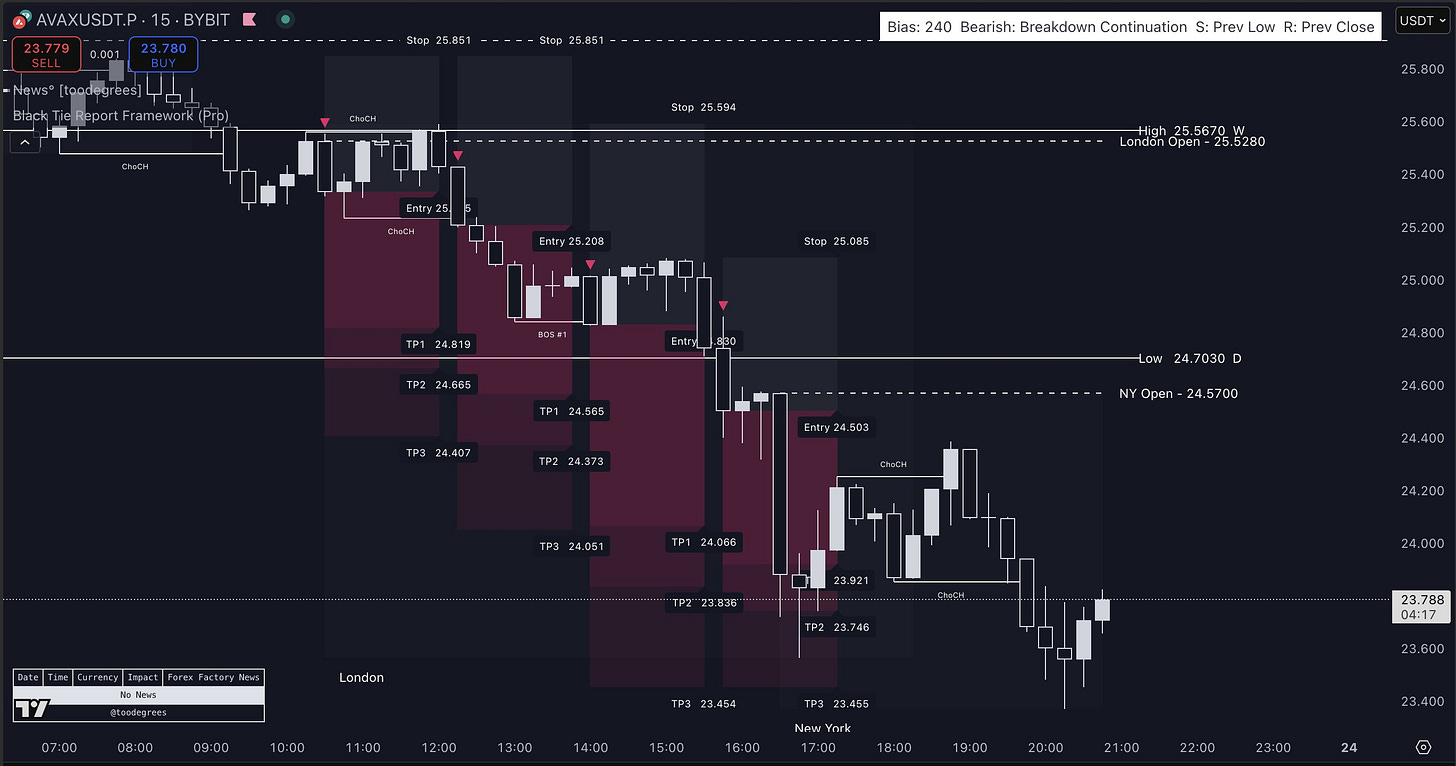

📍Example 4: AVAXUSDT — Four Entries, One Logic

This chart is the best showcase of repeatability. AVAX offered four distinct trade opportunities — all using the same logic.

Setup 1:

– CHoCH confirmed on London open

– Entry post-sweep

– TP hit in minutes

Setup 2:

– BOS after NY open

– Clean retrace → new entry

– Hit all targets

Setup 3:

– Reversal liquidity sweep

– Fakeout confirmed

– TP1 and TP2 with tight SL

Setup 4:

– Final BOS into close

– Micro pullback → breakout

– Final TP to end the day

It’s not that these trades were “lucky.”

It’s that once the structure is clear, entries become procedural.

🧠 What Ties It All Together

Despite the asset class, price behavior follows patterns.

And the Framework doesn’t try to predict, it waits for confirmation.

Each example in this article, whether metals or altcoins, used the same approach.

📦 What You Get with Framework Pro

✅ Daily Bias overlay

✅ Session-based levels

✅ BOS/CHoCH detection

✅ Retest + entry zone mapping

✅ SL and TP auto-placement

✅ Multi-timeframe confluence logic

✅ No repainting. No guessing.

All updated in real time, on any market.

If you’re trading on feeling, Twitter threads, following the latest YouTube trend or crossing your fingers, it’s time to change that.

See you on the next update.